Navigating personal finances as a couple can be a challenge, but with the right tools, it can become an opportunity to strengthen your bond and achieve financial success together.

By using the best budget app for couples, you can improve communication, set shared goals, and manage expenses effortlessly.

In this blog post, we’ll guide you through the top budgeting apps designed specifically for couples and tips on how to make the most of them.

Here is a short summary of what you’ll learn:

- Find the best budget app for couples in 2023 by understanding the importance of budgeting, open communication and setting financial goals.

- Compare features such as ease of use, customization options and pricing plans to make an informed decision that suits their needs.

- Establish boundaries, conduct regular check-ins & updates, celebrate successes to successfully manage finances with a budgeting app.

Understanding the Importance of Budgeting as a Couple

Budgeting as a couple is essential to align financial objectives and ensure that both partners are aware of each other’s own spending patterns, and remaining funds.

With the help of budgeting tools and apps, managing finances becomes easier and helps avoid excessive spending.

To successfully navigate the world of personal finances as a couple, it’s crucial to maintain open communication, set financial goals, and manage shared expenses.

Open Communication

Open communication is the foundation of successful budgeting for couples, as it fosters trust, confidence, and alignment in spending and saving strategies.

Discussing finances openly allows couples to avoid conflicts and stress, ensuring that both partners are on the same page when it comes to money management and shared financial goals.

By setting clear parameters and having periodic check-ins, couples can ensure that their financial plans remain effective and adapt to changing circumstances.

Setting Financial Goals

Setting financial goals as a couple can boost communication and trust, as well as provide accountability and a clear direction for the future.

Topics like building credit, paying down debt, and establishing joint and individual financial goals should be addressed to ensure that both partners are aligned and working towards a common objective.

By defining the financial picture and revisiting these goals, couples can allocate funds effectively and make better financial decisions.

Managing shared expenses is crucial for maintaining a sense of security and balance within the relationship.

By agreeing on goals, responsibilities, and expectations, couples can ensure a fair allocation of expenses based on income.

Digital envelopes, like those offered by Qube Money, allow couples to allocate funds for specific areas of their budget, ensuring transparency and accountability in their spending.

Top Budgeting Apps for Couples to Consider

Some of the top budgeting apps for couples include YNAB, Zeta, Mint, Monarch Money, Qube Money, Goodbudget, and Honeydue.

Each app offers unique features and capabilities to help couples and individual accounts manage their finances effectively.

Let’s take a closer look at each of these apps and their standout features.

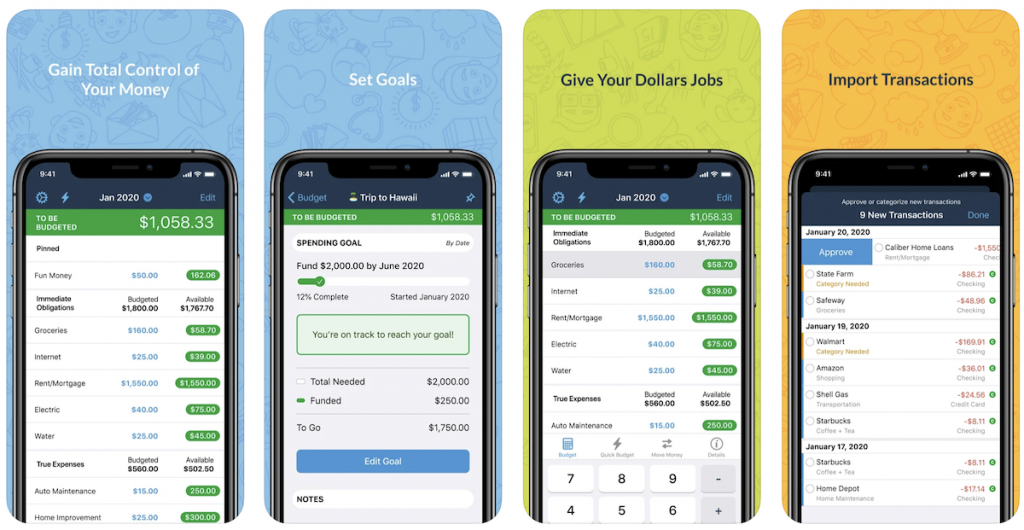

YNAB: Best Overall

Cost: $14.99/month or $99/year

YNAB (You Need a Budget) is a zero-based budgeting system that focuses on tracking everyday expenses and has an impressive rating of 4.8 stars in the App Store.

Zero-based budgeting allocates all your money to expenses, savings, and debt payments. Its goal is to make your income minus expenses equal zero by the end of the month. With this approach, you cannot spend more than you make.

With YNAB, couples can easily sync their joint checking account and allocate their money to different spending categories, keeping track of their shared expenses.

A noteworthy feature of YNAB is its “YNAB Together,” which allows up to five people to join the same budget for the cost of one subscription.

The app is accessible on multiple devices and offers real-time sync, data encryption, and comprehensive progress visualization through graphs and charts.

Money doesn’t have to be messy. The YNAB budgeting app and its simple four-rule method will help you organize your finances, demolish your debt, save piles of cash, and reach your financial goals faster.

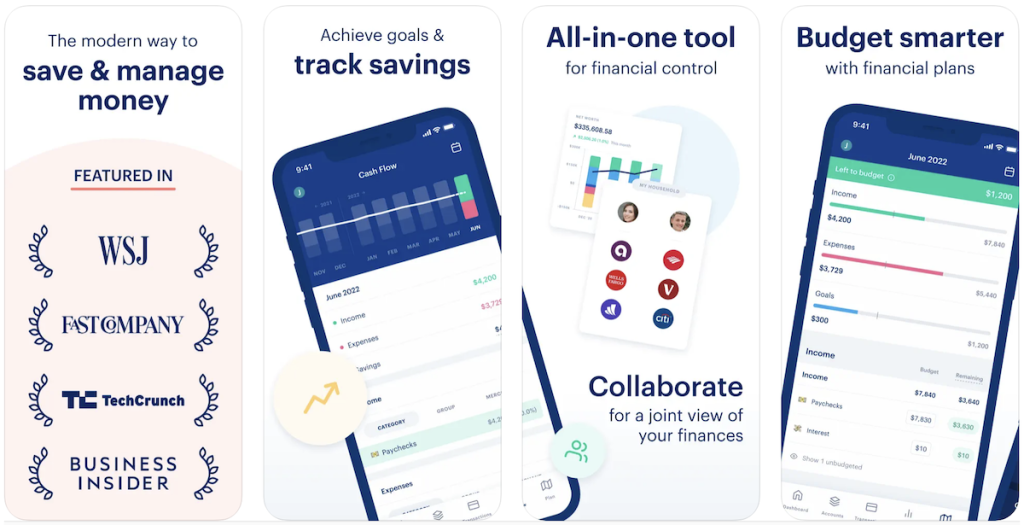

Monarch Money

Cost: $14.99 per month or $99.99 billed annually (offers a 7-day free trial)

Monarch Money offers couples the ability to manage their finances together through a joint account feature.

When you invite someone to your household in Monarch, they’ll get their own separate login and be able to view your data and contribute their own accounts and transactions to your shared space if desired.

It doesn’t cost anything to add other members to your household. Invite as many collaborators as you like.

The app has a 4.8-star rating in the App Store and offers a free trial for the first 7 days, followed by a monthly fee of $14.99 per month or $99.99 if billed annually.

With Monarch Money, couples can easily keep track of their finances, track net worth, and investment accounts, and have peace of mind knowing they can create and customize monthly and annual budgets.

The app is easy to use and provides a great way to manage money together. Plus, the free trial and low monthly fee make it an affordable option.

Monarch is a modern and all-in-one finance tracker that helps users manage money, track expenses, savings, and investments with ease through a customized dashboard.

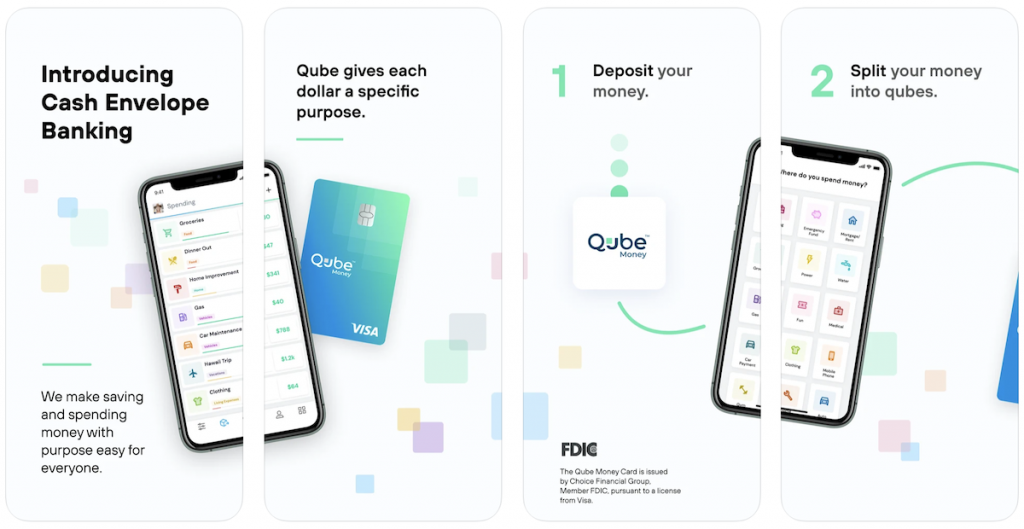

Qube Money

Cost: $0 to $15.00/month

Qube Money is a budgeting personal finance app that utilizes a digital cash envelope system, linking with a debit card to help users monitor their Qubes and manage their budgets digitally.

With a 4.2-star rating in the App Store and a 3.7-star rating in the Google Play Store, Qube Money offers a unique approach to managing finances for couples.

The app is designed to help couples stay on top of their finances and budget together. It allows users to set up multiple Qubes, each with its own budget, and track spending in real-time.

Qube Money has several unique features, making it one of the most efficient budget apps used to track expenses.

For one, the platform allows several people to connect to the same account. This comes in handy for couples and families looking to improve their spending and saving habits.

Qube Money offers affordable rates (including a free basic plan for individual users) and a host of useful features, which makes downloading this app a no-brainer. Budgeting doesn’t have to be complicated or unpleasant with this new budgeting app.

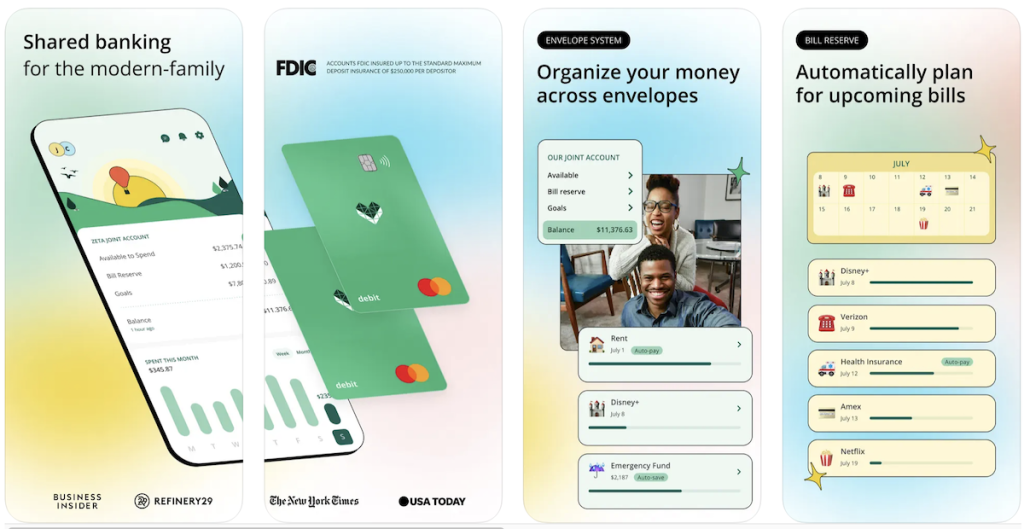

Zeta

Cost: Free

Zeta offers a quick and effortless way for couples to open a joint bank account, taking just 5 minutes or less.

By signing up and inviting their partner to confirm their information, they can each receive their own Zeta Cards, including virtual and physical debit cards. This joint bank account provides several advantages for couples looking to manage their finances together.

With Zeta, couples can consolidate their financial activities in one account. They can easily pay bills, save for goals, and track shared spending, all in a single place.

Zeta is designed to seamlessly integrate with existing accounts, making it a convenient budgeting option.

Zeta takes care of money-related tasks, relieving couples of the burden. The platform remembers bill due dates and can even handle bill payments on their behalf.

The envelope system offered by Zeta breaks down their balance, clearly displaying available funds for spending, money allocated for bills, and savings earmarked for specific goals.

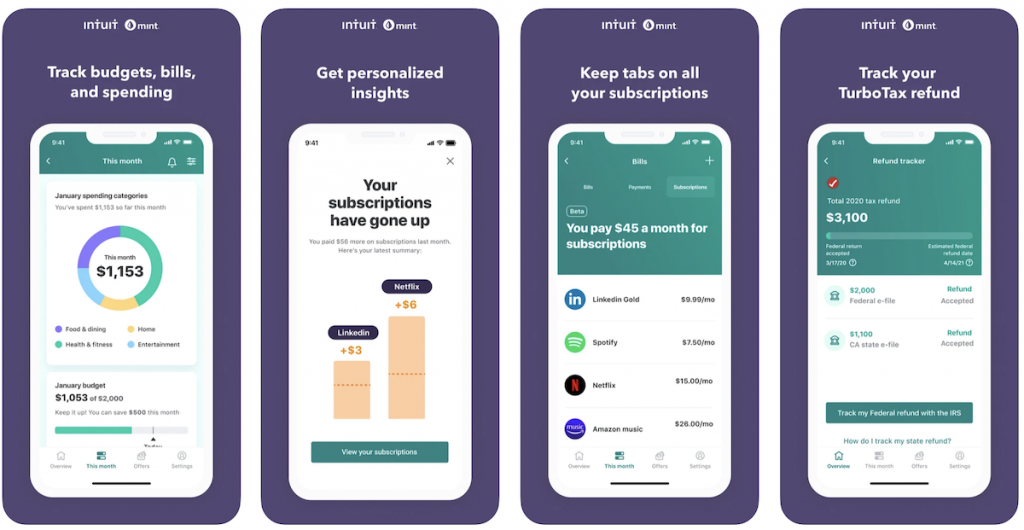

Mint

Cost: Free

Mint, created by Intuit, is a popular budgeting app that offers customizable budgeting, expense tracking, bill reminders, savings goals, and insights into overspending.

The app is free of charge and provides notifications for ATM fees, exceeded budgets, or large and suspicious transactions on linked accounts.

However, Mint may appear overcrowded with advertisements and promotions, which could be a potential drawback for some users.

Related: Is Mint Safe: Should You Trust It With Your Financial Accounts?

Goodbudget

Cost: $7.00/month or $60/year

Goodbudget follows the cash envelope system, providing virtual envelopes for spending categories and a debt-tracking feature.

The free version allows access to 20 envelopes and can be used across two devices, while the Plus version, available for $7 per month or $60 annually, offers unlimited envelopes and usage across up to five devices.

Although Goodbudget doesn’t synchronize with bank accounts to monitor expenses in real-time, it still provides a practical approach to managing finances for couples who prefer the envelope budgeting system.

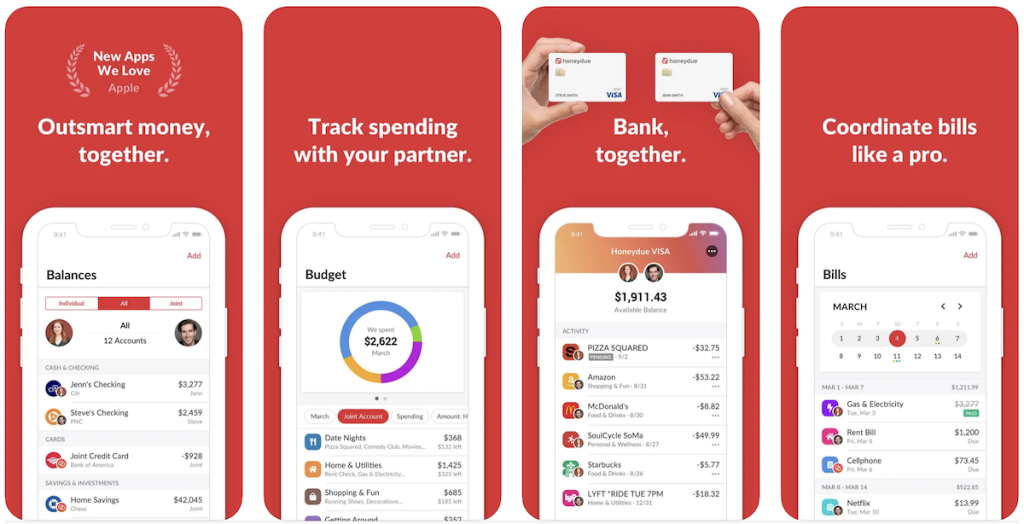

Honeydue

Cost: Free

Honeydue is a free money-tracking app tailored specifically for couples, allowing them to manage their finances together while maintaining financial autonomy.

Users can contribute a monthly donation as a tip, but the app’s core features remain free for all users.

With its focus on shared finances, Honeydue is an excellent choice for couples looking to achieve financial success together.

Comparing Features of Budgeting Apps

When comparing budgeting apps for couples, it’s important to consider factors such as ease of use, customization options, and pricing/subscription plans. Usability and intuitive design ensure a simplified user experience, while customization capabilities enable couples to gain insight into their spending behavior and adapt their budget accordingly.

Furthermore, understanding the costs and subscription structures of various apps can help couples make an informed decision that suits their financial goals and budget.

Ease of Use

An easy-to-use budgeting app can significantly improve the overall experience for couples, ensuring that they can effectively monitor their expenses and stick to their budget without feeling overwhelmed or frustrated.

A user-friendly finance app that allows couples to focus on their financial goals and money management instead of struggling with a complicated interface.

Customization Options

Customization options in budgeting apps are essential, as they allow couples to tailor their experience, classify expenses, and allocate funds to different categories. By customizing budget setup, spending tracking, and expense categorization, couples can gain a better understanding of their financial habits and make informed decisions to achieve their financial goals.

This can help couples identify areas where they can save money, plan for future expenses, and track their progress towards their financial goals. With the right budgeting and investment tracking app, couples can take control of their finances and make the most of it.

Pricing and Subscription Plans

While many budgeting apps offer free versions or trials, it’s important to consider the costs associated with premium features and subscription plans.

For example, YNAB offers a paid version with a monthly pricing option of $14.99 and an annual pricing option of $99.99, while Goodbudget provides a free version with limited capabilities and a Plus version for $7 per month or $60 annually.

By understanding the various pricing options available, couples can choose the best budget app that meets their financial needs and budget without overspending on unnecessary features.

Tips for Successfully Using a Budgeting App as a Couple

To make the most of budgeting apps, couples should focus on establishing boundaries, conducting regular check-ins and updates, and celebrating achievements. These practices can help couples stay accountable, avoid disagreements, and enjoy the journey towards their financial goals together.

Establishing Boundaries

Setting boundaries when using a budgeting app as a couple is crucial for maintaining a healthy relationship and protecting both partners’ finances. By ensuring mutual understanding of the financial split and agreeing on goals, responsibilities, and expectations, couples can create a shared budget app together that works for both partners and fosters trust and collaboration.

This budget should be tailored to the couple’s own joint and individual accounts’ needs and should be regularly reviewed and updated to ensure that it is still meeting their needs. It is important to remember that budgeting is a process and that it is a process.

Regular Check-ins and Updates

Regular check-ins and updates are essential for a successful budgeting experience, as they ensure that the budget remains practical, accurate, and adaptable to changing circumstances. By periodically reviewing their budget and making necessary adjustments, couples can avoid overspending and set aside funds for goals or unexpected events.

Celebrating Achievements

Acknowledging accomplishments when using a budgeting app as a couple is important, as it reinforces positive financial habits and encourages both partners to continue working towards their goals. Celebrating achievements can also strengthen the sense of collaboration and gratitude for each other’s efforts, contributing to a stronger and more successful financial partnership.

Summary

In conclusion, budgeting as a couple can be a rewarding experience that strengthens your relationship and helps you achieve your financial goals together. By choosing the right budgeting app, maintaining open communication, setting financial goals, and managing shared expenses, couples can navigate their financial journey with confidence and success. So, take charge of your finances as a couple and start exploring the best budgeting and budget apps for couples today!

Frequently Asked Questions

Good news: Honeydue is the perfect budgeting app to link with a spouse, as it is specifically designed for couples. Not only does Honeydue offer the ability to connect bank accounts and other financial accounts with institutions from five different countries, but it also allows you to easily manage your money together in a secure, organized environment. Honeydue makes it easy to set up a budget, track spending, and save for the future. With its intuitive interface, you can quickly and easily view your financial situation and make informed decisions about your finances.

Yes, Mint works well for couples. It allows users to sync their accounts, set up alerts, and customize their monthly budget to track both individual and shared financial goals. Additionally, couples can view Mintsights reports and get credit score updates in order to stay on top of their finances together.

The best way to budget as a couple is to begin by setting S.M.A.R.T. goals, determining your joint net income and mandatory expenses, calculating what you need to save, dividing up discretionary spending, selecting budgeting software that works for you both, and scheduling a weekly money date to keep yourself accountable. With these steps in place, couples can find success with their joint budget and financial goals.

Splitwise is the perfect app to help couples easily and efficiently split expenses. Its simple tools make it easy to track borrowing and lending over time, giving users more peace of mind. Splitwise makes sharing expenses with your significant other hassle-free.

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free