If you want to see the best budgeting tools in one place, then you’ll enjoy this guide. I personally tested and reviewed the best free and paid budgeting tools. And you can filter through the list to find the best money saving apps for you that will help you save money.

Managing personal finances is a painstaking task, but that doesn’t mean you shouldn’t pay attention to budgeting. Managing your money is the best thing you can do for yourself in today’s unpredictable economy. And, there are several online budget tools that can help you achieve your goal. That’s second best after you’re done reading the best personal finance books that money can buy!

Whether you want to keep track of finances for a residential/commercial move or are saving up for a car, it’s crucial you stick to a saving or spending plan. Here are a couple of budgeting tools you should try:

Best Budgeting Tools and Money Management Apps

These are the top money management apps to eliminate debt and save money. Get one of these apps and start to better manage your money.

01: Quicken

Quicken lets you take control of your finances. By using it you can plan for today and tomorrow with one solution to manage all of your finances.

The Quicken app lets you see your financial life all in one place:

- #1 personal finance software in the US

- Trusted for 30+ years

- Most trusted brand in PF management software

- Connects to and aggregates information from over 14,000 financial institutions

That’s right, the app lets you get your complete financial picture at a glance. With Quicken, you can view your banking, investment, retirement, and credit card accounts – all in one place. Stay on top of your spending by tracking what’s left after the bills are paid. Make more informed money decisions by creating custom budgets you’ll stick to with this budgeting app. Quicken Mobile Companion App is a free personal finance app to use with your Quicken desktop software.

The app has it all and you can start with a free trial otherwise you’ll pay an annual fee, but Quicken Deluxe includes excellent reports, transaction tracking, short and long-term planning, and good support.

If you’re not a fan of paying — you can see a long list of Quicken alternatives to better manage your money.

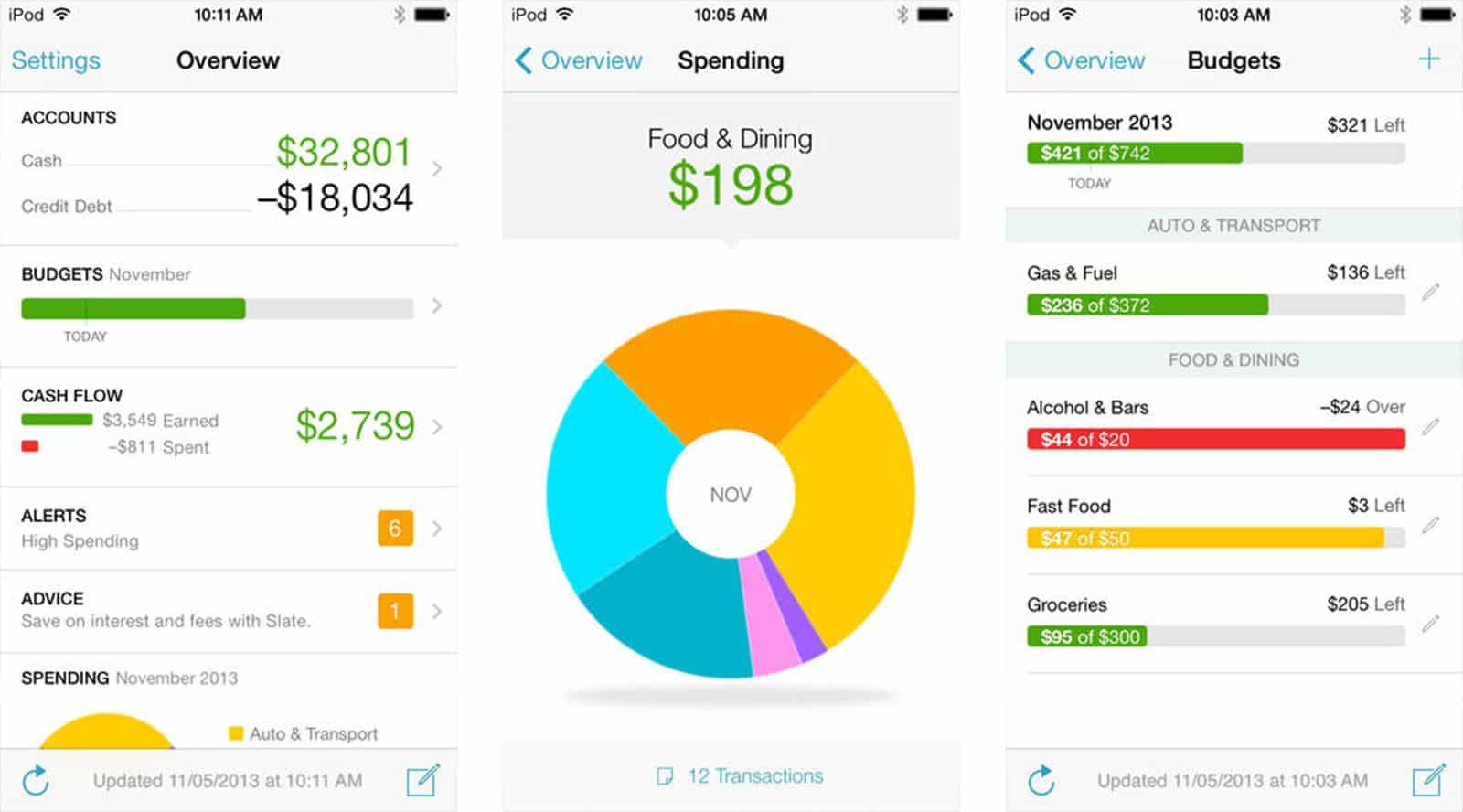

02: Mint

Mint is an incredibly popular online personal finance app that’s great for all kinds of users. Aside from it being a great finance app, it has a plethora of money management tools that you can also use. What’s astounding is that the app is free to use and allows users to create financial reports in a matter of minutes.

Some notable features of Mint include:

- Versatile and flexible budgeting tool

- The app can send you alerts and financial summaries via text message or email

- Extra security measure – the app sends out an SMS or email if it notes unusual account activity

- Account aggregation follows almost all bank-level policies for added security

- Users can customize their financial reports into easy-to-read bar graphs and pie charts

However, the only downside is that Mint does not have an account reconciliation feature. This may be a letdown for some users but otherwise, the app is great on its own. If you already have Mint but want more features, I would recommend signing up for Empower. In fact, Empower and Mint’s features are quite complementary. Users can also keep a track of their credit score with minimal hassle.

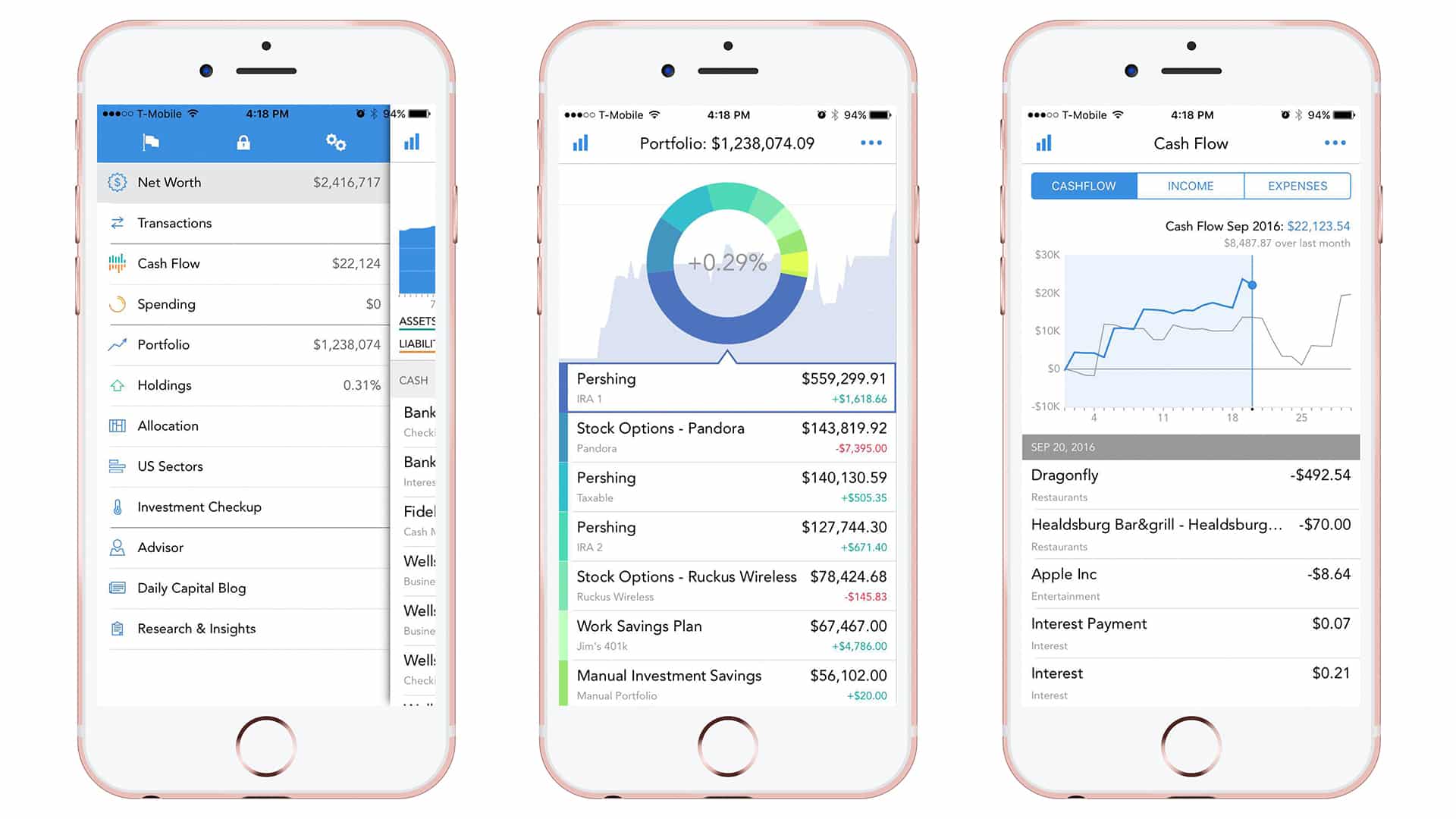

03: Empower

The financial advisor company, Empower offers several free tools to help users manage their budgets and investments. What’s best is that the tool has an easy-to-navigate dashboard, perfect for beginners trying to save up.

For greater ease, you can maximize benefits by linking up both your investment and banking accounts and using it as a free net worth tracker. Empower is a free net worth tracking app that allows you to sync your assets and liabilities and create budgets to meet your personal finance goals.

I’ve been using it for years now and it has everything you would need. Once you create an account, this app will be an effortless way for you to link your accounts and track your entire net worth.

Empower combines smart tools with the personalized touch of a financial advisor to give you an investment strategy that fits your needs through its investment advisory services.

Overall, when you create your account, it will walk you step by step through entering each and every asset and liability, allowing you to easily keep track of your net worth and build a budget that works—for free!

Some key features of this app include:

- Track expenses down to every credit card swipe

- Analyze all your expenses in real time on your account dashboard

- Use the tool to manage your future goals whether you’re planning to buy a house or get yourself a new car

- Use the Retirement Planner tool

- Ability to track your net worth

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

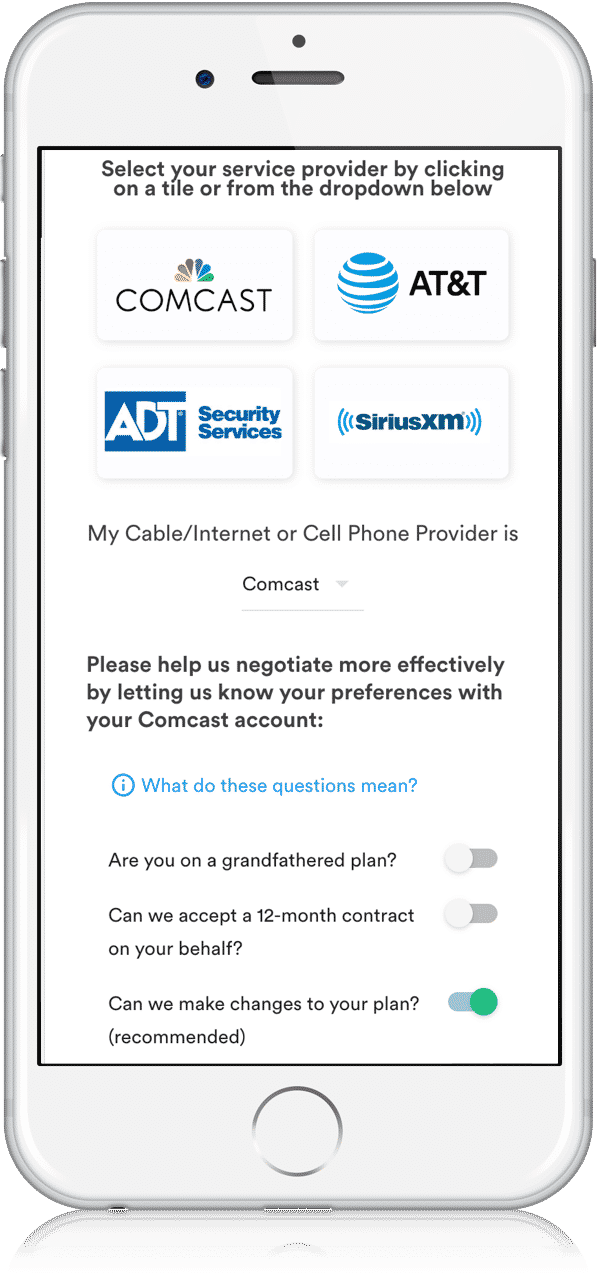

04: Trim

Want to know the cheapest car insurance provider or the best credit card in town? Look no further than Trim. This exciting solution makes it easy to keep track of your financial life.

The good news is that this app makes the right financial decisions and you don’t have to worry about your financial health. Automate savings and find interesting ways to save more money with this genius app backed by AI. Click here to sign up for Trim for free

Use Trim's AI to identify and manage your recurring subscriptions, find savings with your daily expenses and even renegotiate your bills to save you money with month.

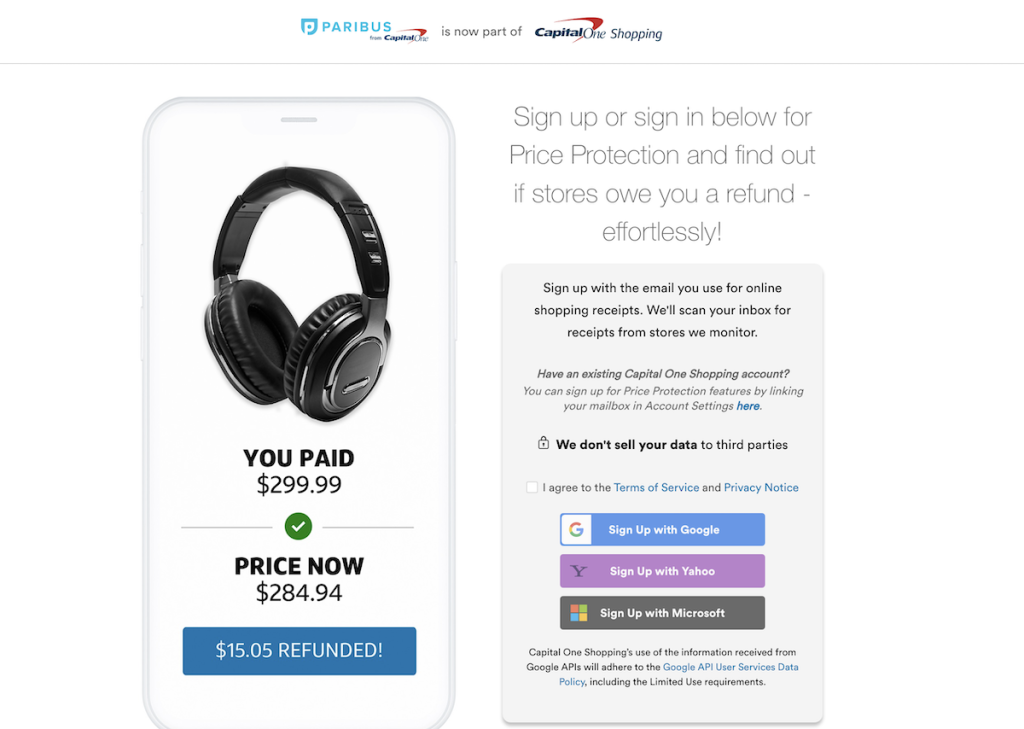

05: Capital One Shopping

Capital One Shopping is an online tool that tracks your purchases to find price drops. The good news is that it is free and you can download the app for both Android and iPhone.

Link your Amazon account to Capital One Shopping and search for price drops at participating merchants. Since Capital One Shopping uses quality encryption to protect data, you don’t have to worry about your purchases made. You can read a Capital One Shopping review here or download the app for free here.

Capital One Shopping Price Protection does the heavy lifting to help you find refunds when prices change. It can even negotiate the refund on your behalf!

Capital One Shopping compensates us when you sign up for Capital One Shopping using the links we provided.

06: LearnVest

Unlike most apps and tools on this list, LearnVest is more advanced and does a lot more than you’d expect. It is better suited for folks with advanced budgeting needs or individuals who want to create their own financial plan. The app requires you to make a little upfront investment so if you’re only looking for free apps, you can move ahead.

But if you’re willing to spend your money wisely, LearnVest provides you access to an advisor. This way, you can have all your questions answered by an expert.

07: YNAB

You Need a Budget also known as YNAB is another popular finance app that has its own super cult following. Unlike other complex tools, it features an easy to navigate spreadsheet design. This makes it easier for newbies to create a monthly budget in minutes.

Another great thing about YNAB is that it focuses on your last month’s income instead of your future income. Plus, all your data is represented in easy-to-understand graphs and reports.

Money doesn’t have to be messy. The YNAB budgeting app and its simple four-rule method will help you organize your finances, demolish your debt, save piles of cash, and reach your financial goals faster.

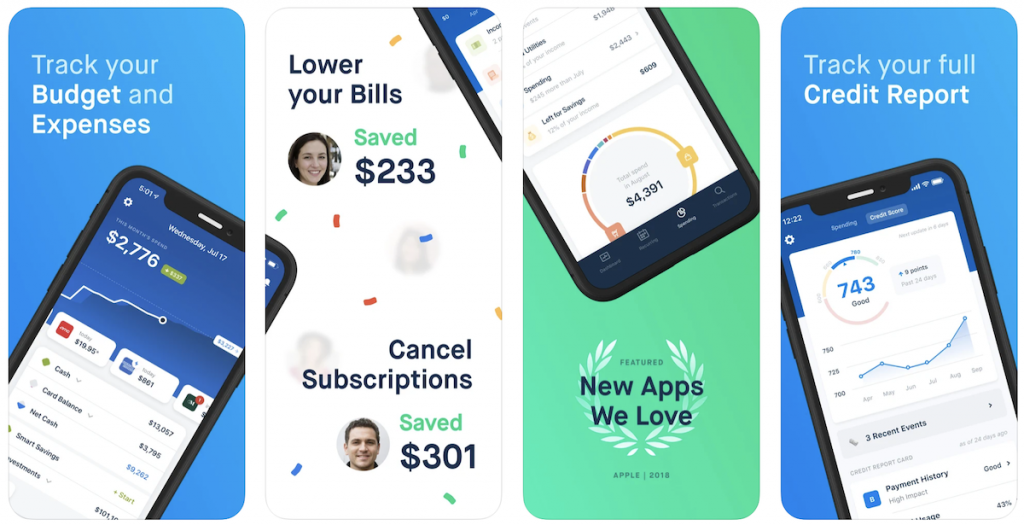

08: Rocket Money

Rocket Money is your automated financial assistant and budget tracker designed to put you back in control of your money. Rocket Money lets you easily track bills, cancel unwanted subscriptions, and proactively requests refunds on your behalf, putting real money back in your pocket.

With Rocket Money, you can save money, find the best credit card, lower your bills, and stay in control of your finances. It’s like your own personal finance watchdog. This free app delivers on its promise to save you money effortlessly. You can use it to lower your bills, cancel unwanted subscriptions and bill negotiations.

Managing money can be hard. Don’t do it alone. Rocket Money empowers you to save more, spend less, see everything, and take back control of your financial life.

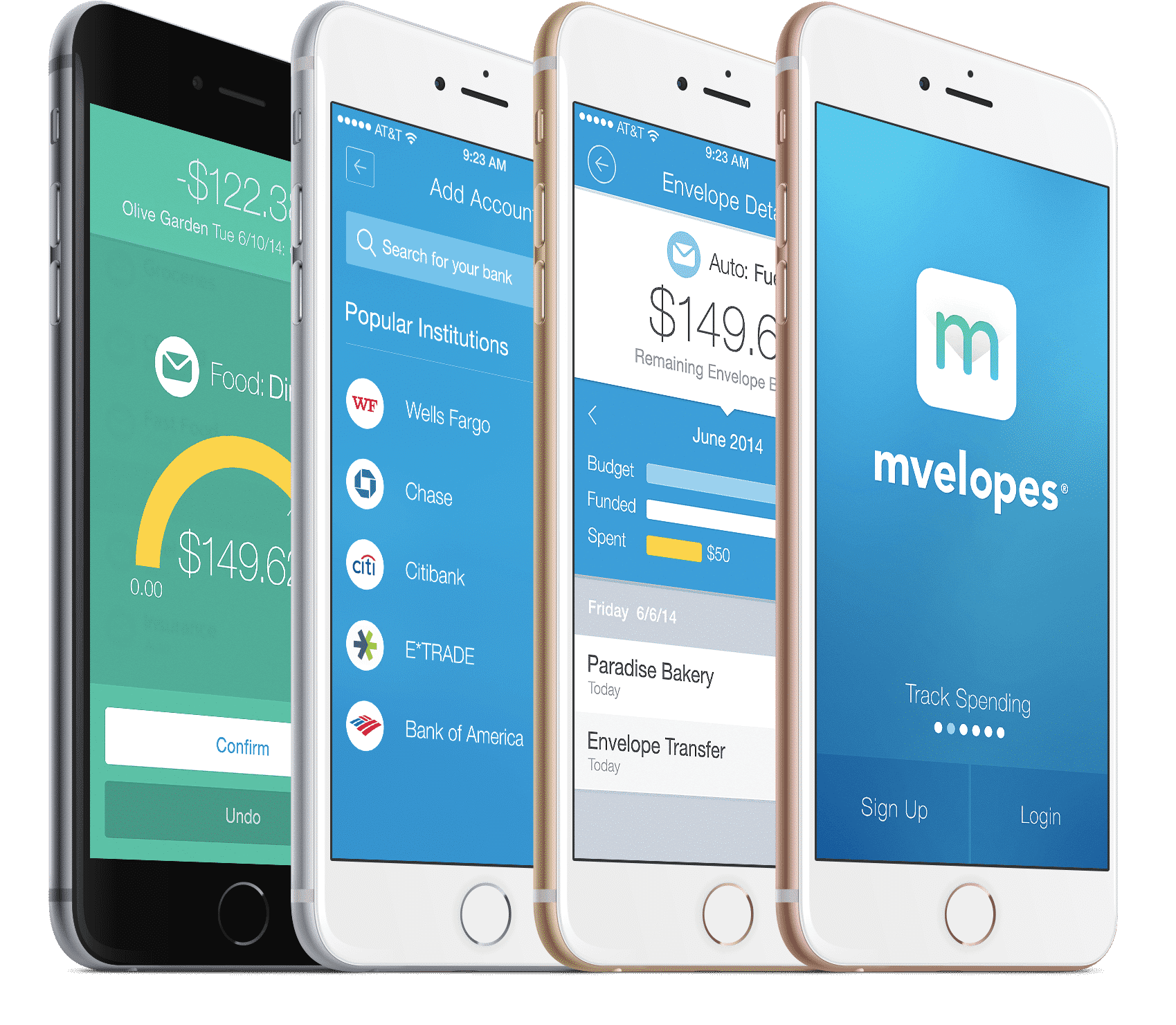

09: Mvelopes

As the name indicates, this app will take you down memory lane with the old envelope system but with a modern or digital take.

Thanks to Mevlopes, you can keep a track of spending by linking all your financial accounts in one place. You can also designate future money to “Mvelopes” and assign yourself a budget. As you use your credit card to pay for something, the app moves the spending account to another Mvelope. This way, you’ll be able to keep track of how much you need to pay for your credit card bill.

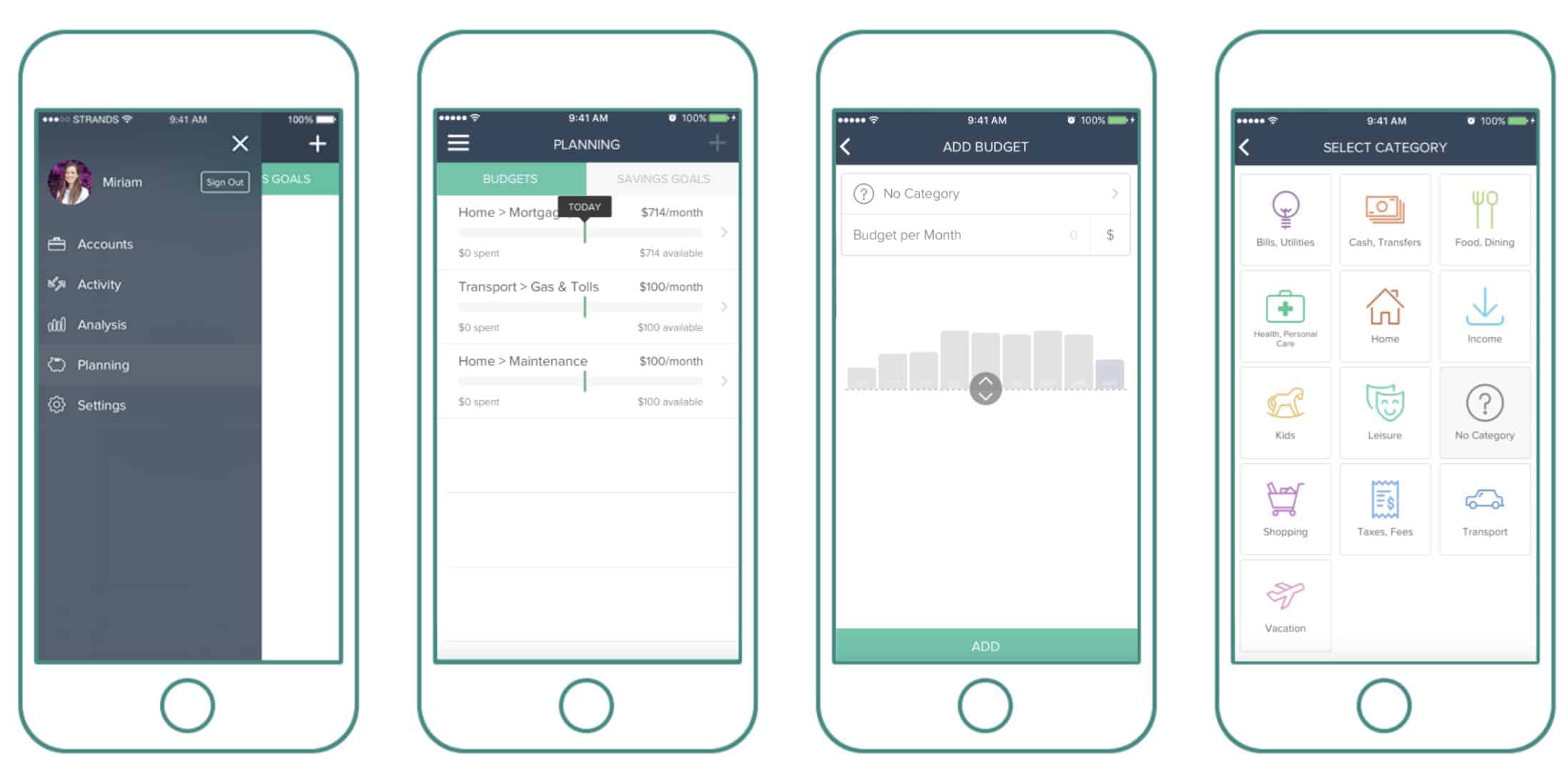

10: MoneyStrands

If you don’t like linking your bank accounts to a third party app or tool, MoneyStrands is the way to go. What’s best is that it works much better than a traditional spreadsheet but with a bunch of cool add-ons.

However, users can link their accounts for greater ease though it is not a requirement. The basic interface looks like a calendar and is easy to manage. Some users have expressed that the app resembles Mint and features a similar interface.

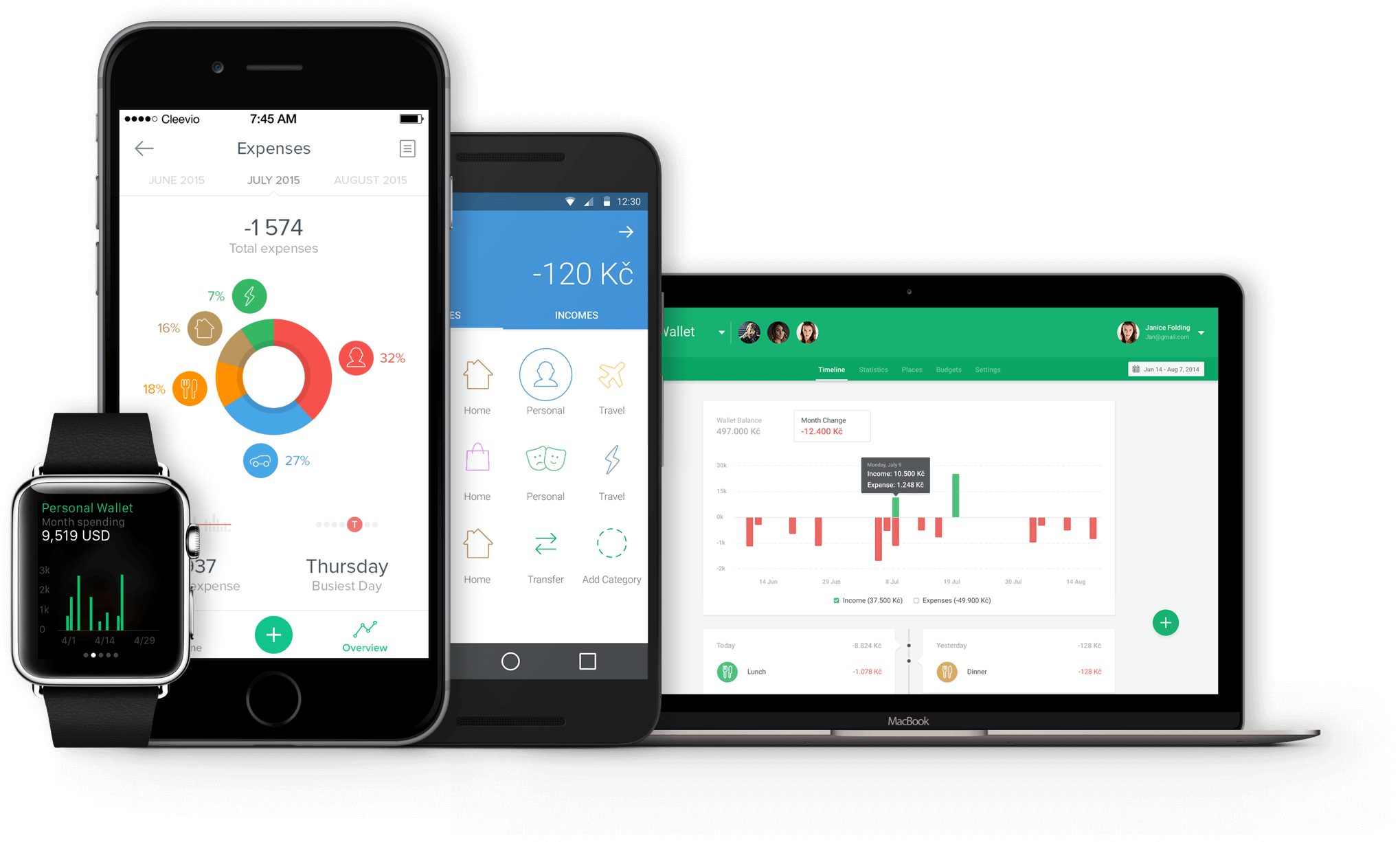

11: Spendee

Are you in need of fuss-free budgeting app that will manage your finances on the go? Well, Spendee is a great choice. For minimal hassle, you can link your Spendee account to your bank accounts and keep track of everything. What’s cool is that the app displays multiple currencies plus you can use a shared account with your family.

While the app is free, you can upgrade your account to premium and avail more benefits. Spendee premium is perfect for budget planning if you want to move your start-up or office to a new location. Real-time sync will ensure that your information is available across all devices.

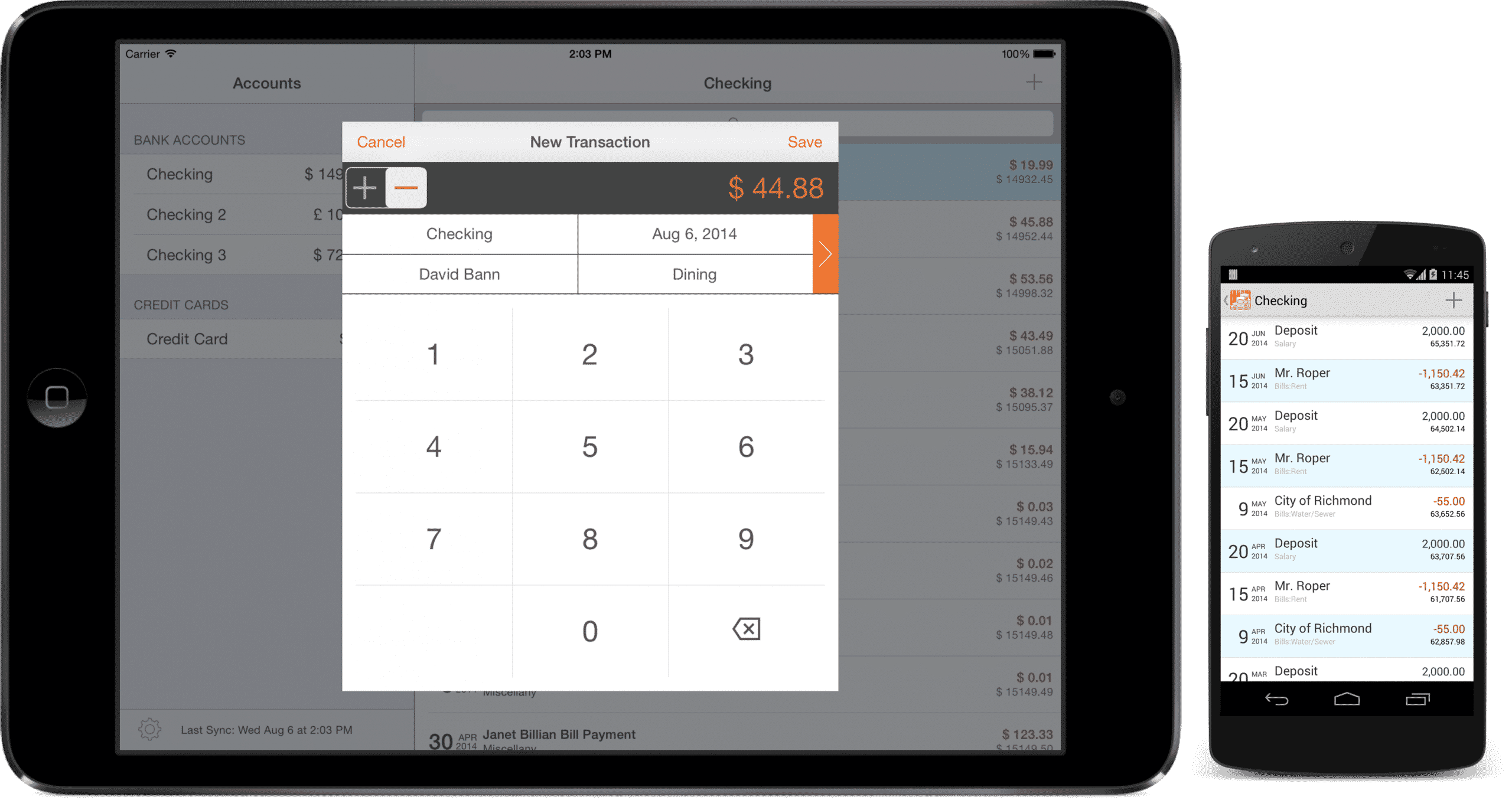

12: Money Dance

This software may not be available for free but it certainly is worth every penny. With numerous features, Money Dance is not only incredibly easy to use, but it also provides a great visual representation of your spending.

For instance, the software looks like a ledger and does an excellent job of summarizing your financial situation including your net worth, liabilities, and assets.

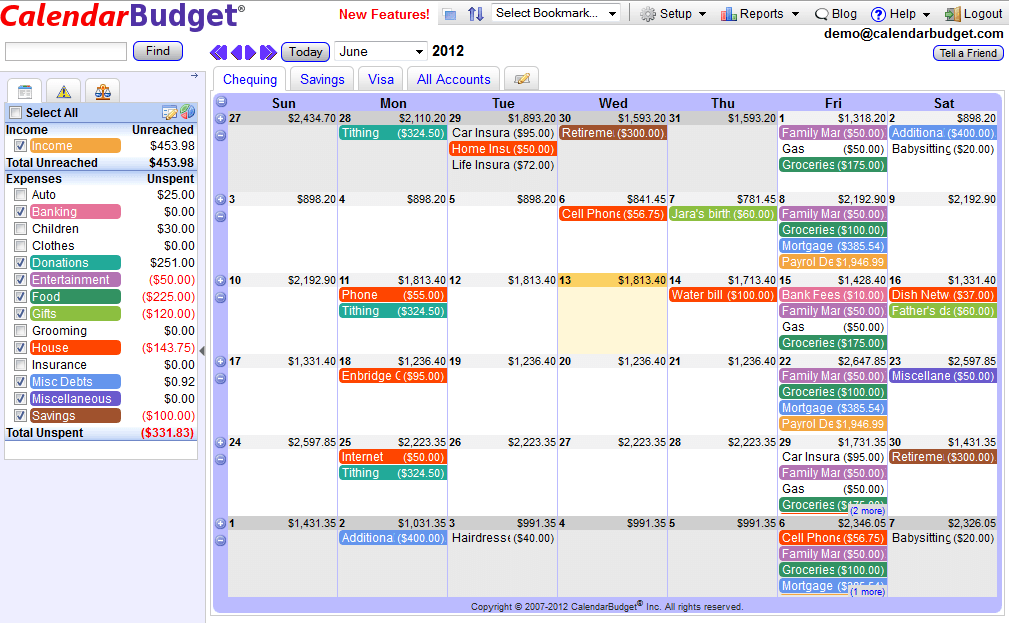

13: Calendar Budget

We will be honest, this is a fairly basic app for budgeting so don’t expect high-end features. Also, it’s also worth noting that Calendar Budget is not a budgeting app and merely works as desktop software. Though it performs better than the traditional spreadsheet.

The only downside? You will have to sit down and enter each expense as you. The calendar will then do the calculations so that you can create a decent budget for yourself.

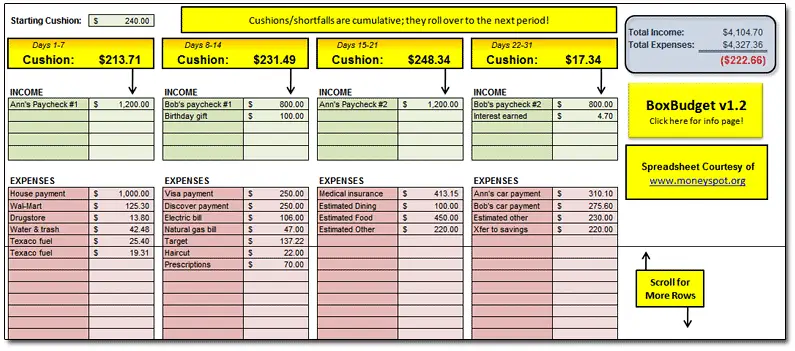

14: Spreadsheet

Whether it’s Google Sheets or Excel, nothing can beat the classic spreadsheet. True, it may not come with all the bells and whistles that you would expect in a finance tool, but it works well.

One of the obvious plus-points of using a spreadsheet is users have complete control over how they can track data. Plus, it is a safer option since you don’t have to integrate your financial accounts online.

Need help setting up your spreadsheet? Tiller Money automatically imports daily spending, account balances, and transactions into Google Sheets and Microsoft Excel. You can customize the spreadsheet to your liking or they also have free budget templates you can use. Tiller Money keeps you up-to-date on your spending with daily account activity emails.

Tiller Money costs $79 a year. Try it out at no cost with a free 30-day trial.

Summary of the Best Money Management Apps

These money management apps take some of the guesswork (and discipline) out of tracking your expenses and finding money saving ideas.

It may take a little trial and error (and more than one free trial) to find the best budgeting tool for you.

Which of these best budgeting tools will you try first? Let us know.

Best Money Saving Apps

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free