Want to save money and earn money? We rounded up some of the best money hacks that’ll make saving money and making money a breeze.

Everyone wants to make extra money or save an extra $100 a month, but it can be difficult to know where to start.

The best part about this article?

A lot of these money hacks require no effort at all.

I get it. Life happens.

Sometimes you need money now or you’re trying to save up for something you want. You don’t want to fall behind on bills and are wondering how to make extra money fast. Sure, another 200 dollars earned today wouldn’t hurt.

We’ve all been there, but what do you usually do when that happens?

This is an exhaustive list of things that anyone can do, today, in order to make extra money the easy way and save it.

If you’re strapped for time, I’ll go ahead and share the best money hacks that will make saving money easy.

The Best Money Hacks I’ve Found

1. Invest in IPOs before they’re publicly available

Eligible SoFi members can invest in upcoming IPOs before they’re traded on the public market—only in the SoFi app.

The app you should know about is SoFi Invest. It’s easy, it’s fee-free, and it’s a bright idea.

Not-so-newsflash: fees are frustrating and they can keep people from investing. It’s why SoFi charges $0 in SoFi transaction and management fees. So there’s no reason not to start investing.

You don’t have to be a pro to invest like one, so get trading. Get a free stock worth up to $1,000 when you sign up through this link.

- Become an investor— without commission fees

- Make your first trade or your next trade with active investing

- Learn the market as you do-it-yourself buying hot IPOs or cryptocurrencies

2. Start saving — without much effort

Rocket Money is a real, much better and desirable alternative to all the other money saving apps on the market. With Rocket Money, they have saved over $15M for its users on their bills (think cable or cell phone bills) and canceling forgotten subscriptions.

Have a cable bill that has been increasing over the years? You can now simply download a free app, and they will negotiate it down for you.

Rocket Money will help you take control of your money, users have saved over $15M to date, and all without being a financial expert or dealing with staying on top of your bills, which can be a full-time job.

There is a reason why they currently have over 50,000+ users, this app really gets you back free money.

If you’re interested, I recommend you sign up for more information from Rocket Money by clicking here.

Managing money can be hard. Don’t do it alone. Rocket Money empowers you to save more, spend less, see everything, and take back control of your financial life.

3. Automate your finances

Set up automatic payments for your bills and savings so you don’t have to think about it. You can do this by setting up direct deposit for your paycheck and setting up automatic payments for your credit card, utilities, and other recurring bills. This will help you stay on top of your finances and make sure that your bills are always paid on time.

You can also do this via budgeting tools like Mint and Empower, which will track your spending and help you set up a budget. Having a budget is key to taking control of your finances and ensuring that you’re spending within your means.

4. Get paid to start investing — with a bonus

Join over 5 million people and start investing your spare change with Acorns! Sign up in under 5 minutes and grow from there with a full financial wellness system at your fingertips. Supported by leading investors, innovators and press like BlackRock, PayPal, Ashton Kutcher, and CNBC.

Sign up to try it risk-free with a $10 sign up bonus.

Remember, you’ll get a $10 bonus when you sign up and make your first investment!

The sooner you start investing, the sooner your money can start to grow toward your goals. This is one of the best money hacks that can help you earn real passive income over time.

With Acorns, you can easily invest your spare change. Anyone can “squirrel” away some money and become an investor with Acorns. Enjoy a $10 welcome bonus when you open a new Invest account. You just need to open the account using the button below and fund it with $5 to earn the reward.

5. Score cash taking surveys

Taking online surveys with Survey Junkie to make extra money is a no-brainer!

You definitely won’t get rich or make hundreds of dollars per day with surveys alone, but you won’t waste much time, and you can make some money the easy way. It is my #1 favorite (and highest paying) survey site:

Survey Junkie: This is a free survey app for your phone that pays you to take online surveys, participate in focus groups, and try new products.

And, I really mean free all around – free to join and they don’t charge anything to be a member (they will actually pay you in cash via PayPal).

Join for free through this link and get your free registration bonus.

Survey Junkie is one of the highest-paying survey sites available. Earn up to $3 per survey with one of the highest-paying survey sites on the web.

6. Earn free gift cards while watching Netflix

Swagbucks is another great money hack to use to earn some easy cash for just pushing a few buttons in your free time. I personally use it and usually make up to $3 per survey while watching TV, and it does add up..

Getting started is easy:

- Click here to sign up. Remember, it’s 100% free.

- Confirm your email to get the $10 sign up bonus.

- Take paid surveys anytime and anywhere via PC, laptop, tablet, or mobile app earning up to $3 per survey.

- Get paid cash via PayPal.

Swagbucks offers a variety of ways to earn money online. You can take surveys, play games, surf the web, watch videos and more to earn points towards gift cards or cash.

7. Get paid to not delete your emails

So this happened. I bought something online from Target. The price of the item that I purchased dropped in price after the fact.

I effortlessly got refunded (for free) without doing a thing, other than originally sign up for Capital One Shopping.

It’s as simple as that.

This free app will scan your emails for any purchase receipts from dozens of online retailers. You don’t even have to know about the price drop in order to get your refund. It’s 100% free and will save you a lot of money.

I pocketed around $50 in the first few weeks of signing up. Remember, it’s 100% free!

Capital One Shopping Price Protection does the heavy lifting to help you find refunds when prices change. It can even negotiate the refund on your behalf!

Capital One Shopping compensates us when you sign up for their service using the links we provide.

8. Get paid to watch videos & collect your $5 right now

The next thing you can do is sign up for InboxDollars which pays you, in cash, to watch fun videos & take surveys.

If you sign up before the end of December, they also give you a $5 free bonus just to give it a try.

By spending just 5-10 minutes per day on this (either on your lunch break or during TV commercial breaks) you can earn and earn an extra $50/month.

More people should be doing this!

InboxDollars offers a variety of ways to earn money online. You can take surveys, play games, surf the web, watch videos and more to earn points towards gift cards.

9. Let Nielsen learn about your internet usage

Have you heard of Nielsen before? They track TV ratings (Nielsen Ratings) and they now want to track how popular apps and online videos are. They do this by measuring normal activity on user’s cell phones and collecting it anonymously.

This company has been around since 1923 and have created a unique app that pays $50 per year just for installing it.

It’s simple, non-invasive, and doesn’t slow down your device or lower your battery life. So, if you want to install the app and collect $50, you can learn more here.

This company will pay you $50 a year to keep their app on your favorite internet browsing device and they also give away $10,000 each month. You don’t have to do anything other than initially registering your computer or phone.

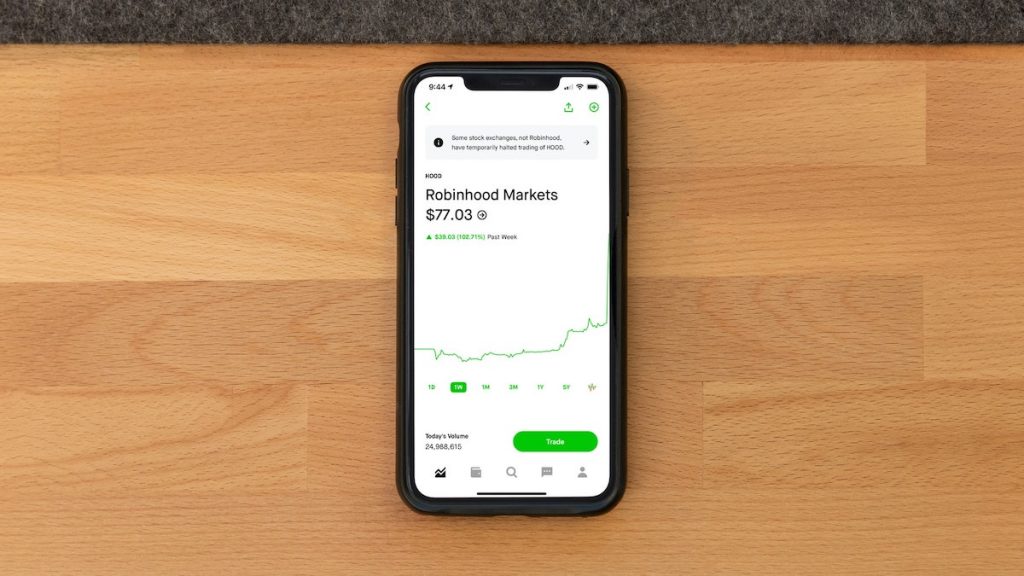

10. Get a free stock from Robinhood

Robinhood offers free investing for everyone with commission-free investing, plus the tools you need to put your money in motion. Sign up and get your first stock for free worth up to $200.

And more free stock (up to a $200 value) every time one of your friends opens a Robinhood account from your promotional link. That’s up to $1,000 in free stock every year.

If you join through this link, you’ll earn a specified dollar amount and be able to pick your gift stock from a list of 18 of America’s leading companies.

The value of the fractional share may be anywhere between $5.00 and $200 and fluctuates based on market movements.

Robinhood has commission-free investing for stocks, options, ETFs, crypto, and tools to help shape your financial future. Sign up and get your first stock worth between $5 and $200, free.

11. Refinance student loans and save money

If you’re ready to refinance your student loans, then you can save thousands or lower your monthly payment.

Student loan refinancing saves you money and you could snag a lower interest rate, decrease your monthly payment, or both. But which lenders are the best to refinance and save money?

We recommend these leading lenders that specialize in refinancing student loans and helping you save money on them. Keep in mind that checking your rate is free, and won’t affect your credit.

If you’re ready to learn more — Splash Financial is the best in terms of rate and helping you lower your student loan payment for both private and federal student loans.

By partnering with a diverse network of lenders, Splash Financial expands borrowers' possibilities and empowers them to make informed decisions about their student loan refinancing. This approach allows borrowers to conveniently compare loan terms, interest rates, and repayment options from different lenders, ultimately helping them secure the best possible outcome for their individual circumstances.

12. Get a better checking account

One of the best money hacks that most consumers should consider is getting a better checking account. There are many traditional financial institutions JPMorgan, Chase Bank, Bank of America, Citigroup and Wells Fargo that offer checking accounts with high bank fees and low-interest rates.

However, there are also some new online banks that offer paychecks up to two days faster than traditional banks when you sign up for direct deposit.

There are no minimum amount of money required to open or maintain an account through these checking accounts and they do not charge any hidden fees. You can see a list of our favorites below:

| Bank/institution | Rating | APY | Learn More |

|---|---|---|---|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

13. Use a personal loan to build credit

When you have a high-interest loan, it could be difficult to repay the amount every month. The most common financing options people opt for are personal loans, payday loan apps and credit cards.

People generally shy away from taking a personal loan as they are known to come with high rates of interest. However, they are still a cheaper alternative to credit cards.

When you have more than one credit card, you will have to pay a high rate of interest on the outstanding amount of all the cards. Even if you opt for a credit card that comes with a 0% balance transfer plan, you will have to finish paying off the amount during the introductory period. Once the introductory period is over, the interest rate will shoot up to a two-digit figure.

When you use the personal loan amount to finance a high-interest loan, you not only reduce the burden on your overall finances but also improve your credit score immensely.

Due to competition from the top banks, you will come across some banks offering personal loans at attractive rates. Generally, the banks with which you have an account already will offer loans at great rates.

Rate: 6.70-35.99%

Loan amount: $1,000-$50,000

Min credit score: none

- Accepts borrowers new to credit.

- Able to fund loans one business day after the borrower accepts a loan offer.

- Offers direct payment to creditors with credit card consolidation loans.

- Allows borrowers to choose and change payment date.

- May charge an origination fee.

- Borrowers can choose from two repayment term options only.

- No mobile app to manage a loan.

14. Buy cryptocurrencies

If there’s one trend from the pandemic that has exploded, it’s the rise in cryptocurrencies. Most famously those of Bitcoin, Ethereum, and Dogecoin that have made the front pages of the press over the past year, these forms of currency are digitally encrypted forms of payment that can be used to buy goods and services online.

While each kind of cryptocurrency has a price associated with the currency, these currencies work similarly to stocks in that they rise and fall.

This is how a small investment can become profitable. As supply and demand shifts, these cryptocurrencies and more businesses begin to accept them as a form of payment in the years to come. It’s also easy to find the best places to buy Bitcoin and other crypto exchanges such as Coinbase and TradeStation Crypto.

Being ahead of the game before this practice becomes a commonplace in society, it can score you some extra spending cash. There are over 4,000 cryptocurrencies out there right now and investing in the next big thing could score you a fairytale kind of come up.

|

|

|

|

Pros:

|

Pros:

|

|

Fees: 1.49%

|

Fees: 0.5% (lowest)

|

14. Invest in real estate

Wouldn’t it be great if you could invest in commercial real estate and apartments without dealing with all the hassle of buying, improving, and re-selling real estate?

You don’t have to be a millionaire to invest in these types of properties. You can now invest in large-scale real estate for as little as $10 with Fundrise.

Through its real estate investing app, investors earned an average of 8 – 11 percent on their money last year, and all without painting a wall or dealing with unruly tenants.

There is a reason why they currently have over 200,000+ users, this app really pays you!

Fundrise is a very easy-to-use app that allows individuals to access crowd-funded real estate investing. This option is best for users who want to make money consistently and let their money make them money.

Real estate investing not your thing? Other smart ways to invest include:

- Acorns: Open a new Acorns account and earn a $10 credit. It’s that simple — no minimum deposit or balance is required. You’ll receive the sign-up bonus credit after completing your account registration.

- Yieldstreet: Yieldstreet is a very easy-to-use app that allows individuals to access alternative investments to build passive income. This option is best for users who want to make money consistently and let their money make them money.

- Masterworks: You own shares of Apple, Amazon, and Tesla. Why not Banksy or Andy Warhol? Their works’ value doesn’t rise and fall with the stock market. And they’re a lot cooler than Jeff Bezos.

15. Track your dividends with dividend trackers

A dividend is the distribution of some of a company’s earnings to a class of its shareholders, as determined by the company’s board of directors.

As an investor, you need to track your dividend income to see if it’s growing or not. Aside from that, following your dividend will help you decide if you should reinvest your income or not.

If you’re looking for the best dividend tracker, you could use Empower. By using the free app. you can easily track the progress of all your investments, including dividends, by looking at simplified graphs.

It also provides risk-level information to help you balance your portfolio. It also gives out suggestions like reinvesting your dividends, and it also allows you to set the period for which it tracks and reports dividend earnings.

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

16. Get help expert help choosing stocks

Motley Fool Stock Advisor has been around since 2002 and is designed to help you outperform the stock market and create real value for your portfolio. I’m not talking about buying meme stocks like GME or AMC. The goal is to buy businesses, not tickers.

Motley Fool Stock Advisor, which is run by Motley Fool co-founders David and Tom Gardner, allows you to find the best investment stocks and it also raises the confidence levels for any investor.

The real value of Stock Advisor isn’t the quantity of stocks, but how good they are and how effective at helping investors make a tidy profit. Some of the top picks include Booking Holdings (NASDAQ: BKNG) and UnitedHealth Group (NYSE: UNH) which has generated returns of more than 950%.

Want to know which stock to buy next? Check out The Motley Fool advisor program and you can get recommended stock picks before the next market close. Plus, if you join today, you can get special pricing as our reader.

Ready to Use These Best Money Hacks to Your Advantage?

While most of these apps can help you make extra money it’s important to save it. If you don’t already have an emergency fund set up, make that your priority.

These money hacks can are designed to keep you out of debt and living below your means.

It is a way of life that enables you to spend as little as possible and use the extra cash to pay down debt, take a vacation that you always wanted, or use your free time to spend quality time with your loved ones.

Did we miss any money hacks? Let us know below!

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free