Dividend investing is one of the ways you can have passive income. Dividends can also help you achieve your financial goals. If you have a particular plan or target based on your investment goals, paying them on time will let your investors know about your efforts. This will encourage them to do the same in support of your company.

Sometimes, dividend stocks experience volatile fluctuations on the stock market. In such cases, they provide significant gains or losses, depending on how the market responds to certain news or event. Investors must remain calm and make appropriate decisions in such cases. Investors who want to enjoy constant returns should choose companies with stable earnings and substantial payouts. A company may continue to offer dividends even if it experiences a decline in earnings, provided the payouts are regular and sufficient.

To constantly check your earnings, you should use dividend trackers. There are many dividend trackers and tools you can choose from. In this article, you’ll have a further understanding of dividends and the different tools you can use to monitor your earnings.

What Are Dividends?

A dividend is a distribution of profit from a company to its investors. Generally, when a company earns surplus or profit, it can legitimately distribute a percentage of that profit to its investors as a dividend. The company usually reinvests any amount not returned to the business.

The shareholders and Board of Directors determine the dividend policy of any given company. Dividend yield can also be determined by looking at the financial statements of the companies in question. All publicly-traded companies are required to provide their shareholders with complete and accurate financial information regularly.

This financial information enables investors to assess the profitability and viability of a company. Accordingly, investors look for companies that can sustain their current market share position which may be affected by general market conditions, industry trends, prevailing interest rates, and other economic factors.

One of the reasons companies give out a dividend is to increase the faith of the organization’s retail investors. Another is to show investors that there’s company growth and future earnings when they invest more in their stocks.

There are different types of dividends:

Cash Dividends

Cash dividends are payments made by a company to its shareholders as a portion of its profit over a given period. This is usually done to increase the share price by reducing the company’s rate of interest and creating additional retained earnings. These dividends are classified as income by the shareholders, depending on the amount they invested in the business and the rate of return they enjoyed from the investment.

Stock Dividends

When a company issues additional shares to its common shareholders without consideration, it’s called a stock dividend. It’s also considered a stock dividend when the company issues less than 25% of the previously issued stocks.

Property Dividends

A company can also issue non-monetary dividends to its shareholders. If a company issues a property dividend, it would be recorded against the asset’s current market price, which is distributed. As the asset’s market price is expected to be below or above its book value, there would be profit or loss that’ll be entered into the books. Companies are forced to issue property dividends to manipulate taxable income intentionally.

Liquidating Dividend

A liquidating dividend is a non-dividend distribution paid by a corporation to its stockholders during its complete or partial liquidation. Typically, liquidating dividends are paid only out of a company’s profit. Instead, most companies distribute the whole amount of investors’ equity during the distribution. The distribution amount is usually based on a formula provided by the company. It’s generally based on the company’s net tangible assets divided by the current market price per share of the equity.

Scrip Dividend

A scrip dividend, also referred to as a free-dividend issue or capitalization issue, is essentially issuing new shares of the company for free to existing investors without any payment to the shareholders.

The distribution of scrip dividend depends mainly on the nature of the issues of securities underlying the dividend. Usually, the dividend is distributed twice each year (once in the first fiscal year and once in the second fiscal year). Under the MIP or minimum investment fund rule, the company has to issue a minimum number of scrip units regarding each issue of its securities.

What Are The Best Dividend Income Trackers?

As an investor, you need to track your dividend income to see if it’s growing or not. Aside from that, following your dividend will help you decide if you should reinvest your income or not. If you’re looking for a dividend income tracker, here are some you can use:

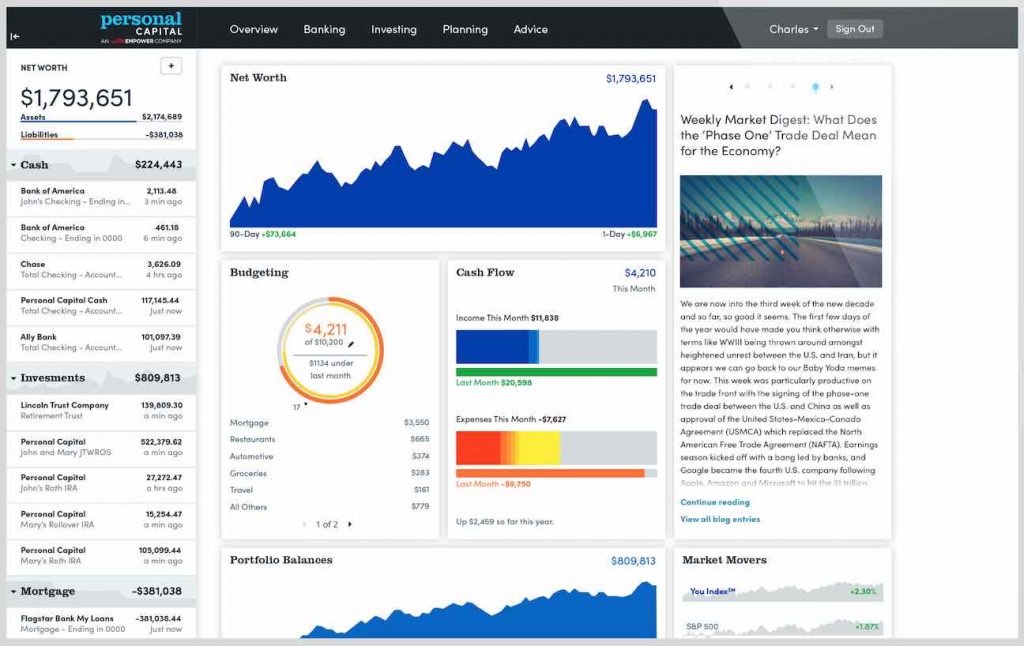

1. Empower

One of the most popular investment apps in the US is Empower. The software has over two million users with assets amounting to over USD 5 billion. The app can track a wide range of investments, including dividend income. If you have a diverse portfolio, you can also track retirement plans and stocks. You can easily track the progress of all your investments by looking at simplified graphs.

It also provides risk-level information to help you balance your portfolio. It also gives out suggestions like reinvesting your dividends, and it also allows you to set the period for which it tracks and reports dividend earnings.

Take control of your finances with Empower's personal finance tools. Get access to wealth management services and free financial management tools.

2. Robinhood

Robinhood is another popular app because it caters to beginners to expert traders. One of the software’s best features is that you get real-time progress on the stocks or dividends you choose and watch how these perform over a certain period.

It also alerts you every time you earn a dividend from your stocks. You can also set it up to instantly buy the stock you want from the dividend income you gained. It also shows dividend history so that you can track dividend performance.

Robinhood has commission-free investing for stocks, options, ETFs, crypto, and tools to help shape your financial future. Sign up and get your first stock worth between $5 and $200, free.

3. Motley Fool

Motley Fool is an excellent resource if you want to have reliable information regarding dividends. Although you don’t get a dividend tracker with the tool, you can still use the app to make better decisions regarding your dividends. The information will help you decide to reinvest your dividend or withdraw your funds. It also provides a newsletter where you stay informed of the latest developments in the stock market.

Want to know which stock to buy next? Check out The Motley Fool advisor program and you can get recommended stock picks before the next market close. Plus, if you join today, you can get special pricing as our reader.

4. Morningstar

Morningstar is another comprehensive investment tracker app you can use to manage your portfolio. One of the highlighted features of the tool is the Portfolio X-Ray which gives you a breakdown of your holdings.

Portfolio X-Ray takes a look at your investments to show how your asset allocation’s holding up, so Premium members can rebalance with confidence. It also lets you evaluate investment ideas, which is useful as market turbulence has revealed numerous buying opportunities across sectors, and Premium membership unlocks all the premium data and ratings.

With the different tools it provides, you can easily use MorningStar as a stock dividend tracker and increase your passive income from these investments. MorningStar has assembled the most popular screeners for Premium members so you can dive right into the best research and investment ideas.

Taking a 14-day free trial of Morningstar Premium while saving up to $100 is the best way to sample all the ways they can help you find, evaluate, and monitor your investments.

If you want a simple and straightforward tool to track your dividend, you can use Sharesight. It has a smooth and powerful interface you can use to create graphs or charts to track your dividend income and other investments. You can even use the tool using a smaller screen, and you’ll still be able to see all the graphs and read the charts.

The app also factors dividends into your total annualized return. With this information, you get an accurate picture of how your dividends are doing, and it makes it easier to track dividend investments.

6. Finbox

For those who have a diverse portfolio, Finbox is one of the best apps to use. It’s a good tool to use if you have a combination of short- and long-term investments. You can easily track your dividend earnings by using their add-ons from Google sheets so that you can create different financial models. Finbox also provides real-time information regarding companies and their market performance.

7. Yahoo! Finance

Yahoo! Finance is one of the basic tools many people use today. It has an intuitive interface that’s easy to use and understand. You can also compare stocks in real-time. If you want to check your dividend stocks, you can zoom out your full-screen chart. With this chart, you can track dividend performance and make comparisons easily.

8. Mint

Mint is a budget app which includes a good dividend tracker that you can incorporate into your monthly budget. You can also link all your accounts like your IRA or 401(k) to track and check how much you have in your investments. It also makes it easier to see how your dividend investments help increase your earnings or how it affects your portfolio’s performance.

If you want to save money, optimize your budget, and reduce your fees, Mint is the app for you. It also offers great support for those who want to include dividends as part of their overall budget plan.

9. Dividend.com

Dividend.com is a tool that focuses on dividends. It’s a top choice for those who want to use it for dividend management and tracking. The tool helps those who want to make more money from their dividends. It has a dividend assistant that lets you sync your brokerage account and an analytical tool that matches dividend-paying stocks based on your monthly goals.

Another useful feature is the Ex-Dividend date which monitors dividend payments. It also has a Compounding Returns Calculator that helps estimate how earnings can be increased from stocks and dividends.

10. SigFig Portfolio Tracker

SigFid is an investment advisor tool, but it also comes with a free Portfolio tracker tool that you can use to track your dividend investments. The tool sends a weekly email to inform you of the performance of your stocks. The email includes graphical data to help you understand the trends. It also provides the latest news regarding your investments.

Although it doesn’t give you advice regarding investments or portfolio management, you can still track dividends through stock performance reviews in real-time.

11. Ticker – Stocks Portfolio Manager

The ticker is another tool that helps you track stock and dividend payments. You can easily manage multiple investment accounts and place them on a single dashboard for easy viewing. It has analytical data to help you understand the performance of your investments better. You can also see your real-time profit and loss values.

12. TrackYourDividends.com

You can visit TrackYourDividends.com and enjoy its many features which are very simple to use. The system easily and securely tracks the performance of dividend portfolio. You can also see total weighted yield and yield on cost.

The tool is free and has no hidden charges. It also helps you diversify your portfolio by helping you determine which stocks or sectors are overweighted or underweighted. It has a dividend dashboard that gives you everything you need to understand your dividend portfolio.

13. Divplan: Dividend Tracker and Calendar

Divplan has a dividend tracker and calendar so that you can calculate and control your payment schedules. It provides all marker data or stocks and bonds from the leaders of the market. It also shows real-time data for your funds. The tool offers you the latest trends in the market, and you can also choose which company or stock you want to monitor.

14. Stockmarketeye

Stockmarketeye is another valuable tool to help you plan and diversify your dividend income. You can easily monitor your portfolio and also check and analyze your profit and loss performance. You can also compare their current yields and payout ratios.

You can also view the stock in the chart to check how much the last dividend payments were. You can also track individual securities like dividend amount, yield percentage, and forward dividend amount. Aside from checking individual holdings, you can also track how your whole portfolio is doing.

Best Trackers for Dividends

Investing in dividends is one of the most common investment strategies used today. Investing in dividends can be very profitable for savvy investors. To effectively grow your money through dividends, you need to use dividend trackers. These dividend trackers help you monitor your earnings and the performance of the dividends through time.

Having a better understanding of your dividend income’s performance helps you make wise decisions on whether to reinvest or not. It also helps to learn more about how you can diversify your portfolio and how your dividend income affects your portfolio’s performance.

Learn More About Investing

- Top 5 Investors to Follow

- Small Investment Ideas for Students with Less Than $500

- What Are the Best Investment Newsletters for Stock Advice?

- 5 Best Investment Apps

- Why You Should Consider Letting a Robot Pick Investments for You

- How to Invest in Biotech Stocks

- The Best Electric Car Stocks to Buy for Long Term

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free