Peer-to-peer (P2P) lending is pretty simple, you lend money to those who wish to borrow, with a view of receiving a great return for doing so. It is also known as “social lending” or “crowd lending”. It’s been around only since 2005, but companies such as Prosper, Lending Club, Upstart, and StreetShares have made the market competitive.

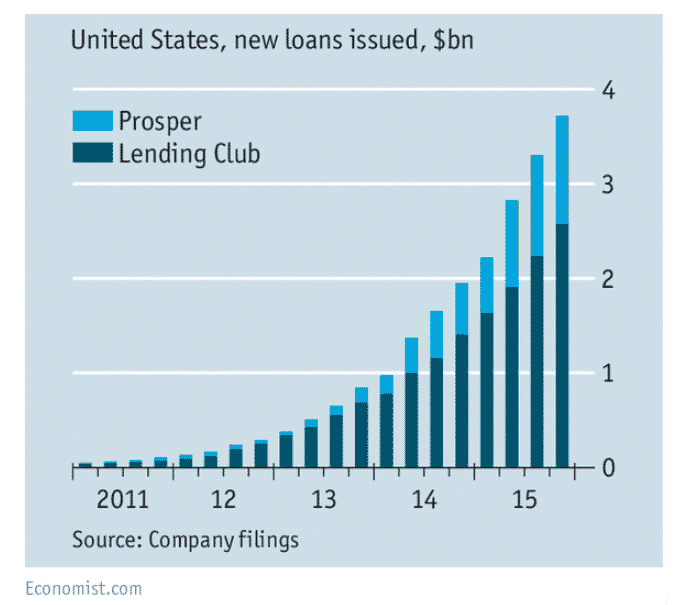

The past decade has seen the rise of peer-to-peer lending in the mainstream. Prosper and Lending Club were the first on the scene with their innovative technology that connects borrowers and investors. The peer-to-peer lending space has seen monumental growth since then, peaking at $3.5B in loans by the year 2015.

Update 12/31/20: LendingClub, as of Dec. 31, is retiring the retail peer-to-peer (P2P) platform that allows consumers to invest in fractions of loans originated by the company, it said in a securities filing last week.

The Beginning

But first, let’s first take a trip down memory lane… Ever since I was a kid I viewed banks as these amazing things that were stuffed full of money.

In my imagination, I could see the vault doors opening and gold bars lining the walls and stacks of money as high as the ceiling.

This is probably due to the fact I watched a lot of Duck Tales growing up.

Don’t get me wrong, banks are rolling in it. But nowadays most of the large transactions are done via the internet at incredibly fast speeds by wire transfers. 20 years ago it would be hard to imagine “getting in the on the action”. Never has there been a better time to act like a bank.

Imagine my surprise when someone explained P2P lending to me. There I was, young and impressionable and someone I looked up to just explained how I could act like my own bank. He, of course, was talking about P2P lending and I was hooked.

In this article we’ll go over: P2P lending explained, how does it work, and how you can get involved with peer to peer lending investing.

Understanding Peer-to-Peer Lending

Generally, when you need a personal loan you can apply at a bank and they look at your credit score, your previous transactions, your net worth, and a lot of other private information. Then they decide to give you money with interest or not.

P2P lending is the exact same thing except you go to a website and ask for the loan and they allow investors to fund the loan and share in the interest payments.

The investors get to act like the bank.

Just as the name suggests, you have peers lending to peers.

Peer-to-Peer Lending Explained: How Does P2P Lending Work?

The two most popular websites for P2P lending are Prosper and Lending Club.

If you were to go to these sites you can ask for a loan for a number of reasons like:

- Home improvements

- Travel

- Medical bills

- Debt consolidation

The P2P platform then performs due diligence and looks into your finances. If you pass their requirements they offer the loan to investors on its platform.

On the investor side, they are able to look at your credit score, how many times you have been late on bills in the past, and your current debt to income ratio amongst other things to fund your loan.

How Does Funding the Loan Work?

When a loan becomes available it is given a score. The score is based on how risky the loan is. In other words, how much interest you are likely to get back measured against the amount of risk for a loan not being paid.

The investor then can purchase as little as $25 of your loan all the way up to the entire amount of the loan.

The loan will sit on the platform for up to 14 days while investors bid and buy up parts of the loan.

How Do Investors Make Money?

As was discussed earlier, every time a payment is made the investor gets their portion of the interest payment and the principal payment back in their account.

For example, if the loan was for $10,000 at 5% interest over 5 years the monthly payment would be $188.71.

Of that $188.71 nearly $42 would go to interest and the rest would go to principal payments.

If I had 1/10th of the loan I would receive ($42*.1) or $4.20 plus my principal payment.

Let’s be clear, this isn’t a get rich quick scheme. Often times the path to wealth is slow and boring.

But what this does for me is it gives me a way to learn more about money, help others by lending to them, and allow me to act as my own bank.

How Does the P2P Lending Platform Make Money?

Nothing in this world is free.

Both Prosper and LendingClub charge 1% annually for the amount in principal an investor has out in loans.

So the more you invest the more you make (theoretically) and the more fees you pay.

I like fees that are structured at a set rate like this because you can be clear what you will pay as you invest more in the platform.

This is assuming they don’t raise the rate to investors.

Why Would You Want to Invest in P2P Lending?

You likely may want to invest in P2P lending because of the following reasons:

- Peer to peer lending has a learning curve. You can view this as a pro and a con. I choose to view this a pro because it keeps people out who are lazy or don’t have time to learn an “alternative” investing strategy. But not you. You are a millennial who is ambitious and curious.

- I love peer-to-peer lending because it allows me to be active in my investing. When I invest in stocks I give my money to a company and pray they do well and don’t get caught doing something illegal and lose all my money.

- With peer-to-peer lending, I get to find loans I want to invest in and decide how risky I want my choices to be.

- It feels good to help others who need a loan. If I have $200 laying around at the end of the money I would love to buy a part of a few loans to help other people out.

- You can invest in peer-to-peer loans through different types of IRA which has tax benefits we won’t cover in this post

Why Wouldn’t You Want to Invest in P2P Lending?

To this point, I have made peer-to-peer lending sound like a no-brainer. You might be thinking, what’s the catch? Okay, here we go.

- The loans are unsecured debt. What that means is you don’t have to put up any collateral (like your house) to get these loans. If someone defaults (stops paying) you are pretty much out of luck. Your options are using a collection agency (costs more than it’s worth) or sell your loan on a secondary market (again takes time).

- It takes time to find the right loans to invest in. Sometimes you login and there are a bunch of great looking loans that meet your criteria, other times…not so much.

- There is a learning curve, you undoubtedly will have no idea what makes a good investment when you start, which is totally okay. There are a ton of blogs and resources you can read to educate yourself.

How Does P2P Lending Fit Into your Overall Investment Strategy

I hesitate to put this section in here because it really depends.

A majority (80%) of my investments are in more traditional investments like a 401k, individual stocks, and a few ETFs (my favorite is the VGSTX fund) and bonds.

Prosper and LendingClub share their default rate data with you and it’s widely accepted that 100 loans at $25 each (or $2,500) is a pretty good number to be diversified. This number of loans should keep you in the game and your money growing but it’s up to you to do the research.

I view this alternative investment option as a way to learn about how lending works and how to be more active with my investments. I can try and target an ROI and buy the loans I need to get me there.

As of this writing, I am getting just under 8% returns on my investment and I normally buy AA, A, B, and a few C level loans. The majority of my loans are A.

Why P2P Lending Is Convenient For Borrowers

Easy Application Process

First, it is an online application that beats you going to the bank or physical address to make the application yourself. Secondly, you can input some of your personal information online and you can get the loan within a few minutes. That means you can apply for a loan anywhere as long as you have internet and computer access. Once your application is approved, you can wait for your funds to be deposited.

Favorable Interest Rates

Any borrower would be happy about the interest rates offered under this lending niche. Currently, the largest lenders in the P2P niche have interest rates as high as 7% APR for all the best customers. Once your application is approved, you will be offered a few payback timelines including 1, 3 or 5 years. The interest rate will be adjusted accordingly depending on your repayment term.

Speedy Access Of Funds

You will not find any other lender who will offer funds so fast. Here, you can get your funding within 1 to 3 weeks depending on how much you have borrowed. You can borrow a small loan of about $5000 and get it funded within a week.

Higher Funding Rates

Over the period that crowdsourced funding has been available, the funding rates have increased. You can get as little as $1,000 up to as high amounts like $35,000. The higher amounts can be used to fund expensive projects and you can repay depending on the repayment plan you have chosen.

Why Do Lenders Love P2P Loans?

Spreading Risk

The lenders in this platform are not big institutions although there might be a few. However, a large number of loans will be funded by smaller institutions and individuals in small amounts. A lot of investors are interested in this alternative compared to the interest rates provided through the traditional banks or other investment options such as the stock market.

High Returns

Depending on the type of loan and the repayment term you have applied for, the return might go as high as 10%. In the current economic market, such a return is actually feasible, especially if it has been diversified into bigger pools of FICO verified and pre-qualified borrowers.

Lenders Choose Their Borrowers

The lenders will categorize the borrowers in their network to make sure they have passed the identity verification process. Any borrowers will get information relating to the interest rate as well as the terms associated with the risk of getting a loan, the credit score and any other information in the funding algorithm. Lenders can choose whichever loan they are interested in and invest in it. You can skip anyone you don’t want and choose someone who matches your preferences.

The benefits to both the lenders and borrowers in the peer-to-peer lending platform can be attributable to the popularity of the option compared to regular financial lenders or banks.

The Future of Peer-to-Peer Lending

As the gig economy grows, it is this author’s belief that it will continue to disrupt industries that have been traditionally gripped by institutions of the past. For example, we’ve seen front and center how Uber and Lyft transformed the taxi industry and made transportation affordable and accessible again.

Many people assumed that the gig economy’s solution to lending started and began with Lending Club and Prosper, but the reality is that many untapped markets exist for the expansion of P2P lending.

The future is bright for P2P lending. Savvy investors should keep their eyes and ears open for new opportunities to make money in this growing sector.

Wrapping It Up

At the end of the day, peer-to-peer lending might not be right for you and your investment goals, but I think it’s important to know what is out there. As Millennials, we are living in the golden age of information.

I would encourage you to actively seek new and exciting ways to invest your money and challenge common beliefs. What got us here won’t necessarily get us there.

Your financial education is on your shoulders and it’s important you are always exercising your money muscle (your brain).

I am curious. Have you given peer-to-peer lending a try? If so, drop me a comment on your experience and what your thoughts are on my article on peer-to-peer lending explained.