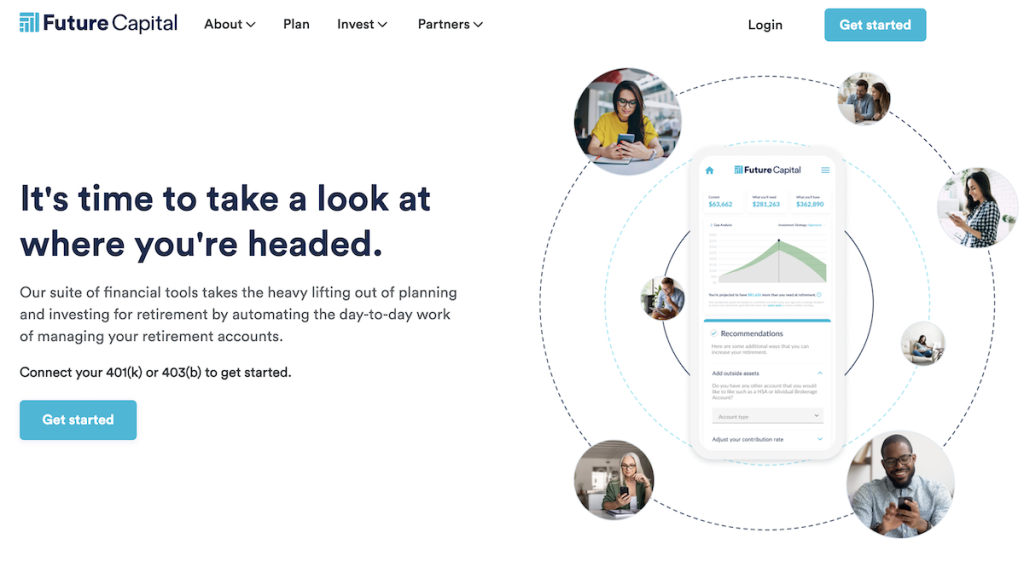

Future Capital's suite of financial tools takes the heavy lifting out of planning and investing for retirement by automating the day-to-day work of managing your retirement accounts.

You can use Future Capital to plan and invest your future all on the same platform. By collaborating with banks and retirement providers, they assist their clients in creating robust financial futures by providing managed account services.

Continue reading to learn more about Future Capital in this Future Capital review.

What is Future Capital?

Future Capital is in business to take the heavy lifting out of managing your 401(k) by analyzing your account and ensuring your money is allocated properly.

By working with Future Capital, you can rest assured they’ll provide a wide range of managed accounts services to make retirement planning less taxing on both your time and resources.

In many cases, organizations already have 401(k)s in place but may find it difficult to manage them properly. This is where the professionals at Future Capital come in to help.

How Does Future Capital Work?

Future Capital does an initial retirement review and its advisory services are complimentary.

This includes access to its retirement counselors and a full analysis of where you stand today in planning for retirement.

If you sign up to have Future Capital manage your account, you will receive active account management, professional investment research, counseling and advice that is typically reserved for larger institutional investors.

With its management services, they research the mutual funds available through your retirement plan and invest in a portfolio appropriate for your age within the strategy you select.

They do the ongoing research of those mutual funds and make any changes needed to the portfolio, including adjustments for plan fund lineup changes and regular rebalancing.

How Much Does Future Capital Cost?

Future Capital is completely transparent when it comes to its fees.

Future Capital’s pricing is based on a monthly subscription model that scales with your account balance.

You can pay like you would for any other subscription service, with a credit or debit card.

Subscriptions start at $9 monthly for the first $50k, and then $20 for each additional $50k managed. Visit the pricing page for a full breakdown.

Future Capital Features

For a low price, Future Capital provides institutional investment advice and management. They make things easier for you by managing your 401(k) and ensuring that your money is invested correctly.

You’ll get a comprehensive initial retirement review that covers where you are now in terms of planning your retirement as well as active account management, expert investment research, counseling and guidance if you open a Future Capital account.

After this, Future Capital will evaluate the different mutual funds accessible through your retirement plan and invest in a portfolio that is appropriate for your age using the strategy of your choice. They’ll continue to study mutual funds and make any necessary modifications to your portfolio, such as altering fund lineup or annual rebalancing.

You also get access to features like:

Future Capital Dashboard

You can access your dashboard anytime to see all of your investments, including your retirement account. Not only that, the platform interacts with a wide range of major retirement account providers, such as Fidelity, TIAA, and Vanguard!

Future Capital IRA

The ‘Innovative Retirement Account’ (IRA) offered by ‘Future Capital’ is focused on utilizing the cash entrusted to a major institutional money manager and incorporating every detail. There is no minimum balance requirement.

Financial Wellness Education

Future Capital will assist you in planning and investing for a more secure retirement through it’s wellness education programs available online.

Frequently Asked Questions

No. Future Capital integrates directly with the financial institution providing your 401(k). They initiate trades on your behalf to make sure that you’ve invested in the optimal funds available to you through your retirement plan.

There are always opportunities for success, but it requires a lot of time and discipline to achieve the same results as dedicated investment professionals. Future Capital has the staff, services and technology to help you reach your retirement goals by focusing on investing so you don’t have to.

You can access your retirement account at any time through the Future Capital dashboard, where you can adjust your investment strategy and track how you’re performing to your goal. You’ll be able to see exactly how your money is allocated within the funds that are available to you through your retirement plan.

Accounts are typically adjusted every quarter. Future Capital may also make adjustments to your account to reflect market conditions or portfolio fund changes and will notify you when these situations occur via your email, if provided, or mailed to you by post.

Yes. Future Capital is required by law to act in its investors’ best interest, rather than their own.

Future Capital vs. Blooom

Editor’s note: Blooom has shut down its services as of November 2022. Existing customers can access their accounts by logging into their institution’s site.

What’s the difference between Future Capital and Blooom? The Future Capital 401k Plan Advisor Plus is a comprehensive platform that provides you with professional management of your 401(k), including an initial retirement review and active portfolio management. On the other hand, Blooom is tailored specifically for people who have a 401(k) through their employer. It’s cheaper and has fewer fees than Future Capital, but it doesn’t offer the same benefits.

Blooom’s pricing is straightforward and uncomplicated: There is no minimum account status, and management costs a flat yearly charge of $45 to $250 per year, depending on the amount of service required and the number of accounts managed.

Which one costs one, Future Capital or Blooom? If you have less than $100,000 in your retirement accounts, Future Capital is the cheaper option.

Future Capital Review Summary

Future Capital is a great way to prepare for retirement, no matter if you a Millennial or Boomer.

For younger investors with longer-term retirement horizons, Future Capital will create portfolios with a mix of funds designed for capital appreciation, with more volatility but a higher return potential.

For investors closer to retirement Future Capital will emphasize capital preservation, with lower return potential, but lower volatility.

As you age, Future Capital will adjust your portfolio accordingly, creating a “glide path” that allows you to benefit from higher returns when you’re young, but giving you more stability as you near retirement.

If you want to try it out just enter your basic information here, set your retirement goals, and get a retirement review today.

Future Capital's suite of financial tools takes the heavy lifting out of planning and investing for retirement by automating the day-to-day work of managing your retirement accounts.

Related Investing Reviews

- Capitalize Review: 401(k) Rollovers Made Easy

- Unifimoney Review: Investing & Money Management Simplified

- Fundrise Review: Invest in Real Estate with Just $500

- Wealthsimple Review: Wealthsimple Makes Investing Easy

- Motley Fool Review: Is The Stock Advisor Program a Good Investment?

- EquityMultiple Review: Modern Real Estate Investing For Accredited Investors

- Groundfloor Review: Invest in Real Estate with as Little as $10

- Robinhood Review: My Experience Day Trading on Robinhood

- Titan Review: A Premier Investment Manager for All Investors

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free