Recently, it has seemed like nothing can stop the stock market. Despite increased volatility related to COVID-19, stocks have more than recovered from last year’s lows. The S&P 500 is up over 60% relative to a year ago, and 22% since January 3, 2020.

Despite the sky-high stock market returns of the past few months, however, many experts are much more pessimistic about the market going forward.

More than ever, investors are looking for a unique asset to protect their portfolio. For some, this serves as a unique hedge against market volatility. For others, it’s a matter of finding an asset that offers significant value—offering a way to enter into a new market before it becomes a household name.

Farmland is one of these premier investment opportunities that you may not have heard about. Farmland investing enjoys steady returns, high stability, and serves as a diversification option with low market correlation.

…That’s not all farmland investing can do for your portfolio, however. Here’s what you need to know about investing in farmland if you’re a first-timer.

What Investors Need to Know about Farmland Investing

Historically, the 60/40 portfolio has been attractive for many investors as a way of diversifying while still achieving robust annual returns. However, this strategy no longer delivers the kind of returns that most investors are expecting, for many reasons.

First, inflation forecasts are still below historical inflation. Inflation is expected to average around 2% over the next 10 years, compared to an average of 3.9% between 1970 and 2020. Low inflation is correlated with lower bond yields and lower nominal equity returns.

Second, rock-bottom interest rates should keep bond yields low for the foreseeable future. Finally, equity valuations are currently at historic highs. If these expectations aren’t matched by a complementary increase in earnings, it will lead to decreased expected returns in the long term.

Farmland is an alternative asset that, like several other alternatives, offers a unique investment opportunity that sits outside the typical blend of stocks, bonds, and investment funds. In many ways, farmland shares similarities with commodities and real estate in a portfolio. Each is designed to provide steady long-term results that can weather market turbulence and inflation.

That’s where the bigger similarities end. Farmland takes your investing dollars further than gold, which experts suggest will cost an average of $1,974 per ounce in 2021. Commercial and residential real estate may be on the brink of a bubble, according to some analysts.

Farmland, on the other hand, provides a better value for your money than gold, and has a track record of performing well even when other real estate assets lose value.

Why Farmland Investing Wasn’t Always Accessible to Investors

If you’re wondering why you may not have heard about the benefits of farmland investing before, there are a few reasons why.

For many years, farmland investing wasn’t accessible to individual investors. Buying a farm outright is out of reach for many, and a lack of tools existed that would make it possible to buy farmland shares.

The farmland investing space was predominated by large institutional investors that had the resources, access to land loans and connections to make large-scale investments that individual investors couldn’t.

The popularization of fractional ownership, particularly through digitally driven investing platforms, has since made it much easier for retail investors to seek out and include farmland investments into their portfolios.

The Advantages of Investing in Farmland

We’ve only skimmed the surface on what farmland investing offers to investors. Offering a better value than commodities and a more stable investment than real estate are just two of the many advantages of investing in farmland. Here are some of the biggest advantages of investing in farmland.

A Superior Hedge Against Inflation

Current market conditions are rife for inflation. Interest rates are near zero, and the Federal Reserve has pumped money into the U.S. economy as part of its economic response to COVID-19. Combine these two phenomena with lingering supply chain issues, which can drive up consumer goods prices, and you’ve got a recipe for inflation that may last a long time.

Farmland investing helps hedge against inflation eating into your returns. Commodities prices tend to increase during inflationary periods, which means that commodity-producing farms end up with crops that fetch higher market prices. This in turn increases the value of your investment.

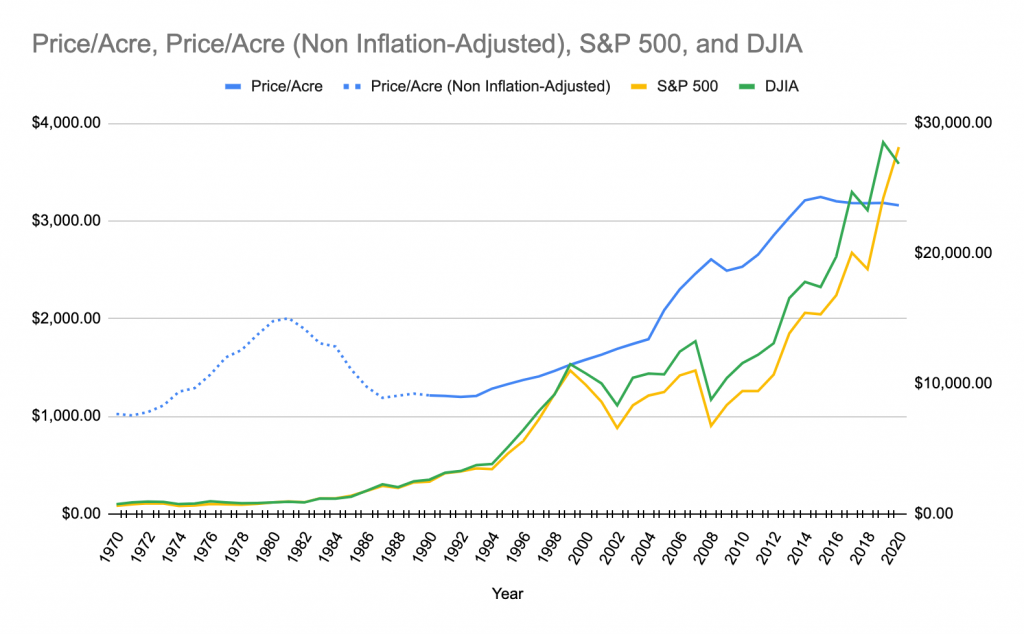

Farmland has also weathered several economic crises, including a period of hyperinflation that began under the Nixon administration in the 1970s. Other economic crises, such as the stock market crash of 1987, the Great Recession of 2008, and even the current period of economic instability due to COVID-19 have all failed to derail growth in farmland value.

Low Market Correlation

When you invest in farmland, you’re establishing a hedge against market downturns with a low correlation with stock market moves. Low correlation means that your farmland investments do not have a history of moving in the same direction as markets. When you combine this with the decades-long track record of farmland’s growth in value, you’re buffering your holdings against future market swings and unpredictability.

Investors who want to offset some of their exposure to the swings of conventional investments look toward low-volatility investments to do so. Investments with low or even negative correlation are a must. Farmland provides exactly that, given that it enjoys a negative correlation with the markets. Put simply, farmland moves in the opposite direction of conventional investments, making it an excellent inclusion in your portfolio when markets are shaky.

Low Volatility

Not only does farmland enjoy negative correlation with the markets, it also has a track record of low volatility as an asset class. The average price of an acre of farmland has increased yearly, on average, since the early 1990s. The same can’t be said for stocks, bonds, and investment funds, which have fluctuated significantly over the same period.

Markets are more volatile than ever before. Investors who want to get off the rollercoaster can invest in farmland to get exposure to a more even-keeled asset. This can be a welcome addition to a portfolio that is otherwise exposed to market swings; farmland investments may not bring in double-digit growth in a matter of months like some stocks can, but it’s also not likely to lose value just as rapidly.

Sustainability-Minded Asset Class

Last but certainly not least is farmland investing’s important role in a sustainable portfolio. Investing in farmland through the right platforms can mean helping farmers access the capital they need in order to implement greener technologies, which can be prohibitively expensive otherwise. The capital required to pursue organic farming, for example, can be a challenge for many farms that operate with slim margins and low cash reserves. Accessing outside investment can help these farms scale up their organic practices without putting themselves into a precarious financial position.

Your investment can even help farmers repurpose unused land for green energy: many farms across the country are converting some of their acreage to wind or solar farms, helping power a new generation of sustainable energy sources. This means your investing dollars are doing more than generating a return—they’re helping to pave a more sustainable future as well.

Why Your Portfolio Needs Farmland Investments

There are a wealth of advantages that investors can enjoy when they incorporate farmland into their portfolio. Farmland investing provides a compelling hedge play against inflation and market volatility, which is more in demand than ever before as market swings become more dramatic. Plus, investing in farmland is a sustainable choice that helps drive innovation for family-owned farms across the country. The more you look at farmland investing opportunities, the more there is to like.

FarmTogether: The Best Way to Invest In Farmland

FarmTogether is an online marketplace that makes it easy to get started in farmland investing. Relevant to competitors, FarmTogether offers many advantages, which we’ll dive into below.

Experienced Investment Team

The FarmTogether team, with a combined experience of more than 70 years of experience across farmland investing, agriculture and real estate in the US and globally, only selects properties that they themselves would invest in. Using their proprietary technology and decades of experience, they sift through hundreds of opportunities to select only the best ones.

Carefully Curated Farmland

The FarmTogether investment process starts with a global macro view, taking into account water availability, climate change, structural regional trends, regulatory landscapes, and long-term trends in improvement in agricultural yields. Next, they incorporate 87 data sets from public, private and proprietary data sources to conduct a property analysis. Finally, they’ll look at the due diligence items relevant to the specific farm, including soil, water, capital improvements, title, local legislation, depth of the supporting farming ecosystem, cost of inputs, farmworker wages, and more.

After evaluating thousands of properties, the team only selects a few (3%, to be exact) to recommend to their clients.

Competitive Returns

When you invest on FarmTogether, you’re purchasing shares in an LLC. You become a fractional owner of the farmland and are entitled to returns from its operation. For a low minimum of $15,000, accredited investors have access to top properties that target 7 – 13% returns with 3 – 9% cash yields – all net of fees.

Cash payouts from operating income are proportional to your ownership in the LLC and are made on a quarterly or annual basis, depending on the harvest sales schedule or lease agreement for the given year. At the end of a property’s target hold period, investors receive their share of capital gains from the sale of their farm.

End-To-End Platform

Through their all-in-one platform, you can identify new opportunities from a variety of farms across the country, review due diligence materials, financials, lease agreements and other helpful information, and monitor your ongoing investments.

FarmTogether additionally has a robust learning center, where investors and prospective clients can find helpful blogs, infographics, white papers, podcasts and more.

You can always learn more about FarmTogether in our FarmTogether review, or can sign up for an account today to be paired with their team of investing experts.

FarmTogether's crowdfunding platform is one of the few ways accredited investors can get exposure to farmland as an asset class. With decent returns and low fees, it is a compelling choice for those looking to diversify their portfolios. The minimum investment amount is $15,000.

Related Resources

- 14 Best Real Estate Investing Apps and Tools to Use

- 14 Best Dividend Income Trackers to Track Your Dividends

- The 6 Best Investment Apps For Everyday Investors

- What Are the Best Investment Newsletters for Stock Advice?

Related Reviews

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free