Lemonade Insurance offers a new approach to renters, condo and home insurance. They even give back up to 40% of unclaimed money to the nonprofit of your choice.

Forget everything you know about insurance. If you want cheap renters insurance then you’ll wtot ot learn about how Lemonade is designed differently than other insurance companies.

Powered by technology and transparency, you can get homeowners and renters insurance fast and simply, all from the comfort of your phone.

Say goodbye to paperwork and agents, file claims instantly, and choose a cause you believe into giveback money to at the end of the year.

Is Lemonade Insurance legit though?

You’ll learn just that and if it’s the right insurance company for you in our review of the Lemonade Insurance company.

What is Lemonade?

Featured: Lemonade Insurance  At www.lemonade.com At www.lemonade.com |

Quick facts about Lemonade Insurance

|

Here are the basics: If you are looking for home insurance or renter’s insurance, Lemonade protects you against material damage and reconstruction costs.

This means that if the structure of your house is damaged (walls, ceiling, floors, etc.), Lemonade can protect you.

Cost and Coverage

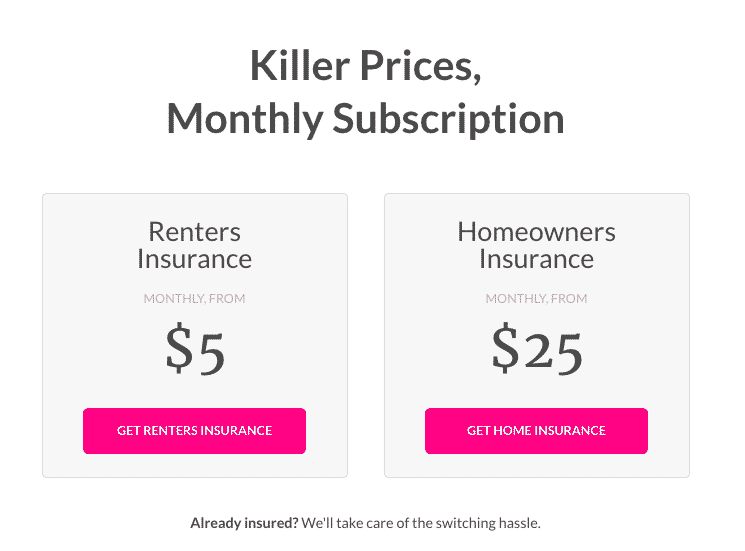

How much does it cost though? They have a simple model.

| Get Renters Insurance In 90 Secs, From $5/month

• Takes 90 seconds to get insured, minutes to get claims paid • Renters policies start at $5/month; homeowners at $25/month • Zero paperwork, zero agents, instant everything |

Homeowner? Get Insurance in 90 Seconds

• Get Insured and Settle Claims Instantly. No Brokers, No Paperwork • Protect Your Home and Your Phone, Laptop, Bike, and More • Unclaimed Premium Goes to a Charity You Choose • Zero paperwork, zero agents, instant everything |

Lemonade Features

Lemonade stands out for various reasons, especially among the “typical” insurers of the market.

The Lemonade Experience

Lemonade is lovely for the younger generation, which is especially visible in the automated approach. You can get the full “Lemonade experience,” as the company calls it, via the iOs or Android app.

Lemonade Giveback

Traditional insurance companies make money by keeping the money they don’t pay out in claims. This means whenever they pay your claim, they lose profit. This is why getting your claims paid fast and in full is sometimes so hard.

Lemonade was built differently.

They take a fixed fee out of your monthly payments, pay reinsurance (and some unavoidable expenses), and use the rest for paying out claims. In essence, they treat premiums as if they were still your money and return unclaimed remainders in their annual ‘Giveback’.

Giveback is a unique feature of Lemonade, where each year leftover money is donated to causes their policyholders care about. They treat policyholders who care about the same causes as virtual groups of ‘peers’.

Lemonade uses the premiums collected from each peer group to pay for the group’s claims, giving back any leftover money to their common cause, and uses reinsurance to cover for cases where the group’s claims exceed what’s left in the pool.

This way, their customers enjoy amazing insurance, and society gets a little push for the better. It also means that, unlike traditional insurance companies, they are not in conflict with their customers, so they are happy to pay claims fast and with no hassle.

To sum it up, with Lemonade, a certain percentage of all premiums automatically go to the operating costs. This ensures that wages can be paid and that the company can buy “reinsurance.” All that remains is transferred to another account that pays for approved claims. Here, Lemonade distinguishes itself from everyone else: if there is still money in the pot at the end of the year, it is not returned to the company and does not increase the profit.

Lemonade is a P2P Insurance Company

Lemonade is based on a peer-to-peer model. They create as the first P2P insurance company on the market.

Lemonade benefited from low prices in the reinsurance sector. Investors have invested in insurance and reinsurance companies in the hope of earning money, i.e., by investing the premiums that insurers collect before claims are paid.

As a result, the reinsurance policy has become relatively cheap. Lemonade has been able to conclude reinsurance contracts for several years, according to an article published on its blog in August 2017.

The company itself does not try to make big profits by investing. “Although it is possible to get something with float, it is not what drives our economy,” says Schreiber.

Lemonade sold $10 million in policies last year and only offers them in 19 US states and the District of Columbia. However, an Accenture executive recently revealed that Lemonade Insurance has already shown how an insurance company can be built around new technology. “They have awakened the industry,” he says. “Let Lemonade use it, or another company.”

Only Available In Certain States

Lemonade Insurance is only available in 20 states. As of May 2018, Lemonade offers renters and home insurance policies in:

- New York

- California

- Illinois

- New Jersey

- Rhode Island

- Texas

- Nevada

- Georgia

- Ohio

- Pennsylvania

- Maryland

- Iowa

- Wisconsin

- Arizona

- New Mexico

- District of Columbia.

Pros

|

Cons

|

Lemonade Insurance Review Summary

Your house is your refuge. Whether it concerns the actual structure or something important within the walls, most of us feel compelled to protect our home. This often includes the purchase of the right homeowners or renter’s insurance policy which the insurance company Lemonade now offers.

With the current economic conditions, money should be saved whenever possible. If you aim to have adequate coverage and the cheapest rate of home insurance or renter’s insurance, you should be aware of what different companies are offering.

By doing these reviews, you will know what other insurance companies are offering home insurance policies so that you can compare them with your insurance. By comparing these quotes, then you can save more money. If you want to get the lowest rates on your insurance, you can get by comparing these quotes.

Lemonade can be a great option for you if you are looking to save money on your homeowners or renter’s insurance.

Lemonade Insurance offers a new approach to renters, condo and home insurance. They even give back up to 40% of unclaimed money to the nonprofit of your choice.