With Aspiration Spend & Save™, get the world’s first cash back account that lets you track the impact of your spending - all managed through one intuitive app.

We all use a checking account to pay for bills and everyday purchases. But, is there a better option for parking your cash than just relying on your checking account?

If you’re not currently using a high-interest savings account or cash management account, Aspiration could be the answer.

Aspiration Spend & Save is an online-only cash management account that lets you enjoy the flexibility of similar features to a checking account while earning up to 5.00% APY on your Save balance when you subscribe to Aspiration Plus.

Plus, you even earn rewards for shopping at more environmentally-friendly and ethical companies, so you can do some good with your everyday spending.

In my Aspiration Spend & Save review, I’m covering all of the features, fees, and pros and cons of this online cash management account so you can decide if it’s right for you.

What is Aspiration

Aspiration is an online-only financial firm that offers cash management and investment accounts for customers.

The company was founded in 2013, but it’s worth noting that Aspiration isn’t a bank. Rather, Aspiration Spend & Save are a Cash Management Account where funds are deposited into one or more FDIC-insured banks every night.

This means your money is still insured, but Aspiration relies on a network of partner banks to accomplish this. Deposits are insured up to $250,000 per partner bank, currently at $2.50 million per depositor.

Technicalities aside, Aspiration is more than your basic online cash management account. The company also strives to protect the environment and encourage its customers to make ethical purchases. Plus, Aspiration pledges to donate 10% of its earnings to various charities, so the company truly puts its money where its mouth is.

The basic Spend & Save account also uses a “pay what’s fair” model, so you can choose $0 per month and avoid account fees altogether.

They also offer an Aspiration investment account that lets you invest in a professionally managed mutual fund that is 100% fossil fuel-free which is open to new investors.

Overall, Aspiration provides a straightforward, affordable way for customers to manage their spending while maintaining a sense of environmental and social stewardship.

How Does Aspiration Work?

When you open an Aspiration Spend & Save account, you’re opening a cash management account, not a checking or savings account. Cash management accounts are brokerage accounts you use to hold, spend, and earn interest on cash.

You provide your email address to sign up for Aspiration’s Spend & Save account. Once you open an account, you can make a deposit to your Aspiration account just like a bank account, meaning checks, electronic bank transfers, direct deposits, and money orders work.

The minimum deposit for opening an Aspiration Save & Spend account is $10. Aspiration mails customers a physical debit card, but you can use a digital Spend & Save card with the Aspiration app right away.

How Much Does Aspiration Cost?

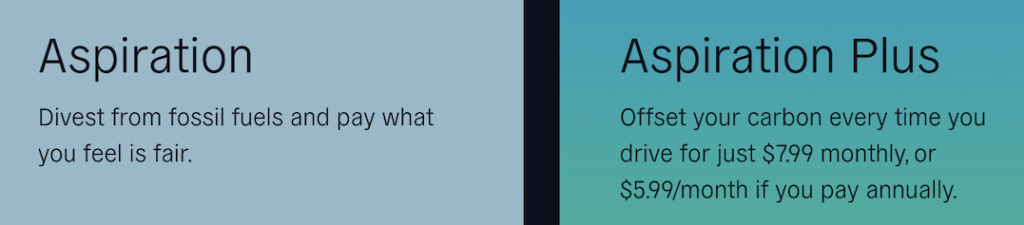

The basic Aspiration Spend & Save plan uses a “pay what’s fair” model, so you decide the monthly fee for your account even if it’s zero.

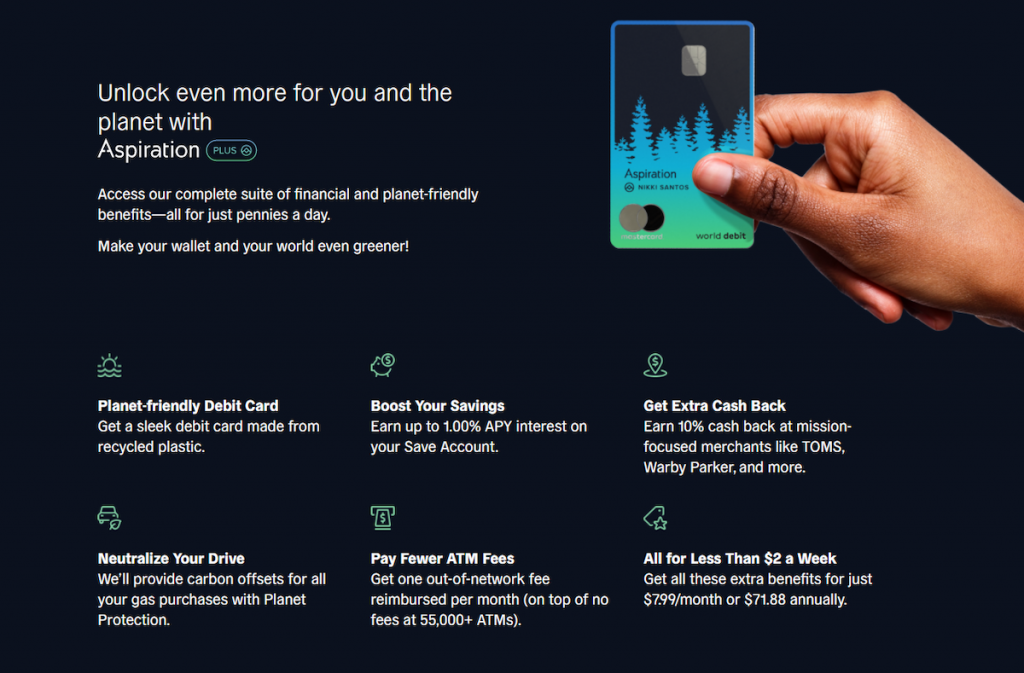

Aspiration Plus costs $7.99 per month if paid monthly or $71.88 per year if paid annually, which is 25% cheaper than paying monthly.

Aspiration Features

Aspiration’s Spend & Save account has two tiers: Aspiration and Aspiration Plus, the premium version of the cash management account. Both versions have similar perks, like fraud protection, free Allpoint ATM withdrawals, and the option to plant trees by rounding up your spending.

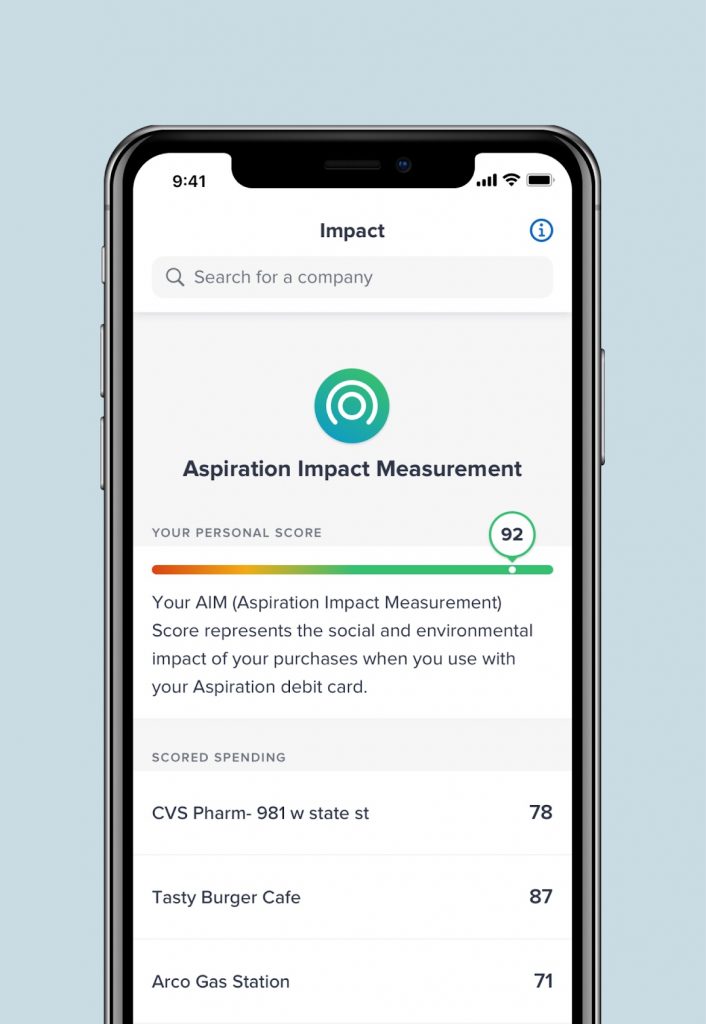

Aspiration also uses an Aspiration Impact Measurement (AIM) score that reflects if you’re spending at ethical businesses. AIM-scored businesses have a “people” and “environment” score, so you can monitor if you’re spending at companies that treat employees well and care about the environment.

You also earn 0.5% cash back for shopping at companies with high AIM scores. Examples of eligible retailers include CVS, Disney, and Walgreens. You can view the list of highest AIM score businesses on Aspiration’s website.

Additionally, Aspiration lets you earn extra cash back with its Conscience Coalition program. This coalition has companies that make a significant effort to “do the right thing”, and includes names like:

- Arcadia Power

- Blue Apron

- Imperfect Foods

- TOMS

- Warby Parker

Overall, perks are fairly similar between standard and premium Spend & Save accounts. However, Aspiration Plus has some notable differences that might make the monthly price worth it.

Aspiration (Spend & Save Plan)

As mentioned, Aspiration’s basic plan uses a “pay what’s fair” model, so you can pay as little as zero dollars per month to keep the cash management account open.

Features of this account include:

- Your deposits don’t fund fossil fuel projects like pipelines and oil drilling

- Fee-free ATM withdrawals at 55,000 Allpoints ATMs

- Earn 0.5% cash back on high AIM score purchases

- Earn 3-5% cash back on Conscience Coalition purchases

- Get paid up to two days early

- The option to plant a tree by rounding up your debit card purchases to the nearest dollar

- Personal impact score to track if you’re spending at ethical businesses

- Earning up to 3.00% APY on savings

Aspiration Plus

Aspiration Plus has all of the same perks as a basic Spend & Save account, but rewards are better. Plus, you can also earn higher interest on some of your funds if you meet certain requirements. Aspiration Plus perks include:

- Earning up to 10% cash back on Conscience Coalition purchases

- Getting one out-of-network ATM fee reimbursement per month

- Drive carbon neutral: Each month, Aspiration will tally up your gas purchases and automatically buy carbon offsets to make your driving carbon-neutral.

- Earning up to 5.00% APY on savings

You only earn a 5.00% annual percentage yield (APY) on the first $10,000 in your account. Additionally, you need to spend $1,000 per month with your Spend & Save account to earn 1.00% APY. If you don’t meet the spending requirement, you earn 0.25% APY. Balances over $10,000 earn 0.10% APY.

Paying $7.99 per month is steep unless you can leverage Conscience Coalition cash back and consistently reach 1.00% APY. However, you should do the math and consider how much Conscience Coalition shopping you normally do to see if it’s worth it.

When you open an Aspiration Plus account, you used to earn a $200 welcome bonus earning when you spent $1,000 in the first two months (offer is no longer live). This is a great way to make quick money online.

Aspiration Plus also has a Planet Protection program that automatically offsets the climate impact of every gallon of gas you buy. So, when you refuel with Aspiration Plus, Aspiration actually buys carbon offsets like additional tree planting to keep your carbon neutral.

Who is Aspiration Best For?

Aspiration isn’t your average online cash management account. This company blends financial management and ethical consumerism, which is a refreshing change if you want your spending to make an impact.

However, Aspiration’s Spend & Save account has some limitations that potentially make it less suitable for high net-worth individuals who have over $10,000 in cash.

The ideal Aspiration customer:

- Doesn’t require a physical branch or cash deposits

- Wants free ATM withdrawals

- Consistently spends $1,000 per month or more

- Wants to promote environmental stewardship and corporate ethics

- Holds around $10,000 in cash for everyday spending

Who Shouldn’t Use Aspiration?

The main downside to Aspiration is its expensive monthly fee for Plus and the $10,000 limit and $1,000 monthly spending requirement to earn the higher interest rate. Because of these two drawbacks and the nature of Aspiration’s mission, you shouldn’t use Aspiration if:

- You want physical bank locations

- You rarely withdraw from ATMs

- You have more than $10,000 in idle cash

- Environmental and ethical spending isn’t a massive motivator for you

If you have over $10,000 in your emergency fund or idle cash, you’re definitely better off using a high-interest savings account to earn interest since you won’t face the same $10,000 interest limit.

Aspiration Pros & Cons

If you’re wondering if Aspiration’s Spend & Save account is right for you, consider the advantages and disadvantages before opening an account.

The Pros:

- Aspiration offers highly rated iOS and Android mobile apps

- No minimum balance required to maintain account

- Earn up to 10% cash back for ethical spending

- Pay what you want in monthly fees for the standard account

- Earn up to 5.00% APY, which is significantly higher than the national average

- Save money on ATM withdrawals

- Funds are FDIC-insured

- Help Aspiration contribute to various charities

- Option to plant more trees and offset carbon emissions

The Cons:

- Several requirements to earn 5.00% APY

- Lackluster interest on funds over $10,000

- Expensive monthly fee for Aspiration Plus

- List of cash back partners is small

- Debit card transactions aren’t available in every country (check full list here)

The bottom line is that Aspiration’s Spend & Save account is useful if you want an online-only, flexible account for everyday spending that still earns meaningful interest.

However, you should leverage the sign up bonus and cash-back rewards as much as possible if you really want to benefit from what Aspiration has to offer.

Aspiration vs. Competitors

Aspiration is an excellent cash management account if you want to spend ethically and earn 1.00% APY on your balance. But if you have over $10,000 or can’t meet the $1,000 monthly spending requirement, several Aspiration alternatives are likely better choices.

| Feature | Aspiration | CIT Bank | Axos | Credit Karma | SoFi |

| Monthly Fees | Your Choice from $0 to $20 for Basic, $7.99/month for Plus | $0 | $0 | $0 | $0 |

| APY | 3.00 to 5.00% | 0.40% | 0.61% | 0.30% | 0.25% |

| Min Balance for APY | $0 but $1,000 in monthly spending | $25,000 or $100 monthly deposits | $0 | $0 | $0 |

| Sign Up Bonus | None | None | $20 referral program | None | $100 |

| Get Started | Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Aspiration offers up to 5.00% APY with Plus which is better than the competition. If you take advantage of the welcome bonus, you can easily offset the cost of Aspiration Plus and still enjoy some free money.

If you have over $10,000, the CIT Savings Builder is a better choice than Aspiration Spend & Save. Similarly, if you want more investment options or to even automate your investing, SoFi is the best choice. You can see the latest APY rates in the table below and compare.

The key with using high-interest savings accounts and cash management accounts is to maximize your interest and perks while minimizing fees. As long as you’re putting your spare cash to work as much as possible, you’re making the most out of your finances.

If you’re interested in comparing Aspiration, visit our recommended online banks that have good checking and savings accounts along with add-on services that can help you handle your finances.

But if you’re looking for an online account with some appealing perks, the Aspiration Spend & Save account is a solid option.

FAQs

Aspiration makes money in several ways, including fees from Aspiration Plus or customers who choose to pay for a basic account, Aspiration’s credit card, Aspiration’s investing service. Plus various fees, like issuing a stop payment, returned item charges, domestic wire ins, and domestic wire outs

Aspiration’s physical and digital debit card is legit. Your deposits are insured through the Aspiration Insured Bank Deposit Program, cash balances in the Aspiration Spend and Save Accounts are deposited at one or more FDIC-insured depository institutions (each a “Bank”) up to $250,000 per Bank. With ten banks available, Deposits are FDIC-insured up to $2.5 million per depositor.

Aspiration’s debit card also lets you earn cash back, so it’s a robust debit card that’s also zero-fee if you don’t opt for the Plus plan.

As part of Aspiration’s commitment to have customers Pay What is Fair, there is no fee for any accidental overdraft. The company encourages customers to regularly check their balances on the mobile app or online to avoid any fund availability issues.

You can deposit money in your Aspiration account by using electronic (ACH) transfers, wire transfers, using third-party apps like PayPal or Venmo, and mobile check deposits.

You have several options for withdrawing money from your Aspiration Spend & Save account: including ATMs, electronic (ACH) transfers, wire transfers, and using third-party apps like PayPal and Venmo.

Aspiration is a privately held company that was founded by Andrei Cherny and Joseph Sanberg. The company has also raised over $200 million in capital from investors, including celebrity figures like Orlando Bloom and Leonardo DiCaprio.

Aspiration is not a chartered, federally insured bank. It offers a cash management account that has some similarities to Fidelity Investment’s cash management account. As such, your deposits are insured through the Aspiration Insured Bank Deposit Program, cash balances in the Aspiration Spend and Save Accounts are deposited at one or more FDIC-insured depository institutions (each a “Bank”) up to $250,000 per Bank. With ten Banks available, Deposits are FDIC-insured up to $2.5 million per depositor

Phone hours are 6 a.m. to 6 p.m. PT Monday through Friday and 8 a.m. to 4 p.m. PT on Saturday and Sunday. The contact number is 800-683-8529. You can also submit a request online of view their questions & answers page.

The Bottom Line

Aspiration is a newer player in the world of online-only cash management accounts, and it’s certainly making a splash. Earning up to 5.00% APY on your funds is an attractive offer. And, by earning cash back for environmentally-friendly and ethical purchases, you can feel good about the money you spend with Aspiration.

Just remember to spend at least $1,000 per month with Aspiration Plus to earn 5.00% APY. Ideally, use Aspiration Plus for everyday purchases and to pay your monthly bills to reach this requirement.

If you can regularly accomplish this, the Aspiration Spend & Save Account is one of the most flexible cash management accounts on the market that’s also making the world a better place.

APY subject to change. The Aspiration Spend & Save Accounts are cash management accounts offered through Aspiration Financial, LLC, a registered broker-dealer, Member FINRA/SIPC, and a subsidiary of Aspiration Partners, Inc. (“Aspiration”). Aspiration is not a bank.

- Get spotted up to $250 without fees

- Join 10+ million people using the finance super app

- Banking with instant discounts on gas, food delivery, groceries and more

- Start investing, saving, and budgeting for free